Chapter Eight

The Founding Fathers

Benjamin Franklin said, "There are three ways a nation can become wealthy.

1. By war, or by taking away the wealth of another nation by force.

1. By war, or by taking away the wealth of another nation by force.

2. By Trade, which to make a profit requires cheating.

2. By Trade, which to make a profit requires cheating.

3. Through agriculture, where by planting the seed we create new wealth as if by a miracle!"

3. Through agriculture, where by planting the seed we create new wealth as if by a miracle!"

Thus far the mathematical impossibility of borrowing America out of debt has been proven. Now, the origin of wealth, as defined by Franklin will be proven.

Thus far the mathematical impossibility of borrowing America out of debt has been proven. Now, the origin of wealth, as defined by Franklin will be proven.

Franklin said: Wealth can be accumulated by winning a war, and taking the wealth of another nation by force. Many immigrants stole land and minerals from Indian Nations and forced them on to reservations. These immigrants possessed a passionate desire for wealth and security, and were strong enough to steal or buy every claim of the Native Americans, the English, French, Spanish, Mexicans, and any other group or nation with an interest in North America.

Franklin said: Wealth can be accumulated by winning a war, and taking the wealth of another nation by force. Many immigrants stole land and minerals from Indian Nations and forced them on to reservations. These immigrants possessed a passionate desire for wealth and security, and were strong enough to steal or buy every claim of the Native Americans, the English, French, Spanish, Mexicans, and any other group or nation with an interest in North America.

So, it's obvious that America's wealth began to accumulate because the founders were not afraid to "make the Kings mad." They were bold enough to capture an entire nation and were strong enough to form a new society from their conquest. Therefore, no one should argue with Franklin's concept of acquiring wealth by war.

So, it's obvious that America's wealth began to accumulate because the founders were not afraid to "make the Kings mad." They were bold enough to capture an entire nation and were strong enough to form a new society from their conquest. Therefore, no one should argue with Franklin's concept of acquiring wealth by war.

Franklin's second method of accumulating wealth is by international trade, which, according to Franklin, requires cheating.

Franklin's second method of accumulating wealth is by international trade, which, according to Franklin, requires cheating.

That statement demands extended examination but it can be proven with a pocket calculator, some basic math, and statistics regarding international trade.

That statement demands extended examination but it can be proven with a pocket calculator, some basic math, and statistics regarding international trade.

The forthcoming information originated from government statistics, most of which are published in the "Economic Report of the President." This report is released each year just prior to the President's State Of The Union Address. It displays dozens of tables, charts and graphs. It contains a narrative that depicts the economy in the best possible light so the political party in power will appear successful and in control. Please call any Government Book Store and order a copy of the "Economic Report of the President" as a compliment to this publication. All the tables in the report (other than net farm income numbers which are misleading) can be used with confidence. The narrative (regardless of the party in power) should be discounted as subjective. The telephone number for the Government Book Store in Washington DC is 202-783-3238.

The forthcoming information originated from government statistics, most of which are published in the "Economic Report of the President." This report is released each year just prior to the President's State Of The Union Address. It displays dozens of tables, charts and graphs. It contains a narrative that depicts the economy in the best possible light so the political party in power will appear successful and in control. Please call any Government Book Store and order a copy of the "Economic Report of the President" as a compliment to this publication. All the tables in the report (other than net farm income numbers which are misleading) can be used with confidence. The narrative (regardless of the party in power) should be discounted as subjective. The telephone number for the Government Book Store in Washington DC is 202-783-3238.

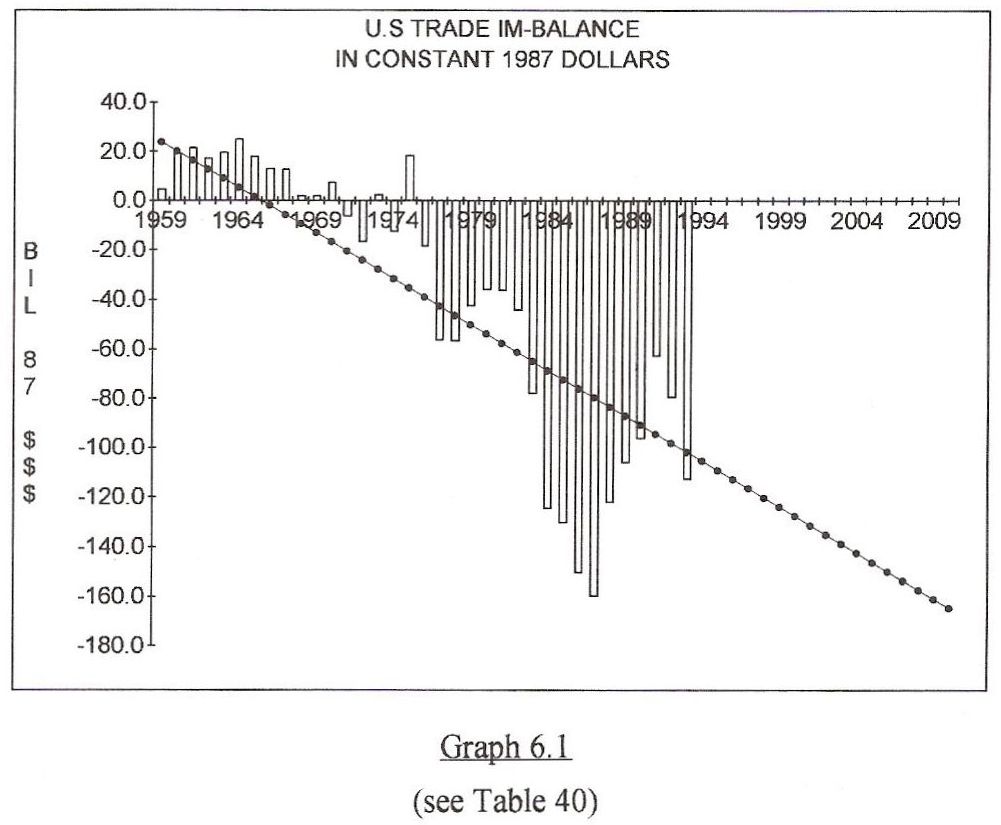

A review of Franklin's second method for wealth accumulation begins by charting annual totals of exports and imports along with their percentage of the Gross National Product (GNP).

A review of Franklin's second method for wealth accumulation begins by charting annual totals of exports and imports along with their percentage of the Gross National Product (GNP).

Graph 6.1

Currently, the United States is not successful at international trade. Total trading losses suffered from 1982 through 1993, exceed 1.3 Trillion Dollars, and losses are growing at the rate of 150 Billion Dollars a year.

Currently, the United States is not successful at international trade. Total trading losses suffered from 1982 through 1993, exceed 1.3 Trillion Dollars, and losses are growing at the rate of 150 Billion Dollars a year.

JAPAN

America's largest trading losses occur with Japan. The following Table describes the full extent of those losses.

America's largest trading losses occur with Japan. The following Table describes the full extent of those losses.

In 1993, America suffered a 60 Billion Dollar trade deficit with Japan out of a worldwide trade deficit of over 133 Billion Dollars. These totals reflect a one-way street of trade deficits that have accumulated to 512 Billion Dollars from 1983 through 1993. During that same period, the Japanese purchased 137.8 Billion Dollars of American public debt securities. The profit from the remaining 364 Billion Dollars was used to buy or build Japanese factories in America, or was simply profit.

In 1993, America suffered a 60 Billion Dollar trade deficit with Japan out of a worldwide trade deficit of over 133 Billion Dollars. These totals reflect a one-way street of trade deficits that have accumulated to 512 Billion Dollars from 1983 through 1993. During that same period, the Japanese purchased 137.8 Billion Dollars of American public debt securities. The profit from the remaining 364 Billion Dollars was used to buy or build Japanese factories in America, or was simply profit.

European countries did the opposite. Europe invested several times more in America's debt than the cumulative trade deficit for the period.

European countries did the opposite. Europe invested several times more in America's debt than the cumulative trade deficit for the period.

Ironically, the Japanese Liberal Democratic Party was forced out of power in 1993 after almost 38 years of rule in Japan, because of a flat economy and "high unemployment." However, at election time the Japanese unemployment rate was 2.5%, and Japan had maintained a trade surplus with America which averaged 50 Billion Dollars annually for a decade. If the situation were reversed in America's favor, it would create an American economic stimulus program that would export American unemployment back to Japan and increase the National Income, but cause pain for Japan. It might raise the Japanese unemployment rate to the level of American unemployment.

Ironically, the Japanese Liberal Democratic Party was forced out of power in 1993 after almost 38 years of rule in Japan, because of a flat economy and "high unemployment." However, at election time the Japanese unemployment rate was 2.5%, and Japan had maintained a trade surplus with America which averaged 50 Billion Dollars annually for a decade. If the situation were reversed in America's favor, it would create an American economic stimulus program that would export American unemployment back to Japan and increase the National Income, but cause pain for Japan. It might raise the Japanese unemployment rate to the level of American unemployment.

FREE TRADE:

PROTECTIONISM FOR MULTI-NATIONAL CORPORATIONS

Classic economics dictates that every commodity and service should be produced and sold into a free, open, and unrestricted market to achieve maximum efficiency and productivity from labor regardless of domestic consequences. This is a distorted version of Adam Smith's "comparative advantage" because Smith required as a prerequisite for "Free Trade" -- the inability of labor or capital to cross national boundaries. Today, both labor and capital are mobile, so developing a free trading environment means more than maximizing the volume of international Laissez faire transactions.

Classic economics dictates that every commodity and service should be produced and sold into a free, open, and unrestricted market to achieve maximum efficiency and productivity from labor regardless of domestic consequences. This is a distorted version of Adam Smith's "comparative advantage" because Smith required as a prerequisite for "Free Trade" -- the inability of labor or capital to cross national boundaries. Today, both labor and capital are mobile, so developing a free trading environment means more than maximizing the volume of international Laissez faire transactions.

THE MEXICAN MAQUILADORA PROGRAM

The unfair trade caused by the mobility of labor and capital is found in the regulations and laws that established the Mexican Maquiladora program. This program is viewed by many as an attack on American skilled labor by American businesses who re-locate in Mexico. Maquiladoras help the Mexican government keep Mexican wages below the wages of skilled labor in America. About 500,000 low wage factory jobs have been created in Mexico through Maquiladora. These jobs pay less than the American minimum wage. These low wages benefit corporations and their stockholders in the short term. They also help Mexico generate hard currency to pay it's international indebtedness.

The unfair trade caused by the mobility of labor and capital is found in the regulations and laws that established the Mexican Maquiladora program. This program is viewed by many as an attack on American skilled labor by American businesses who re-locate in Mexico. Maquiladoras help the Mexican government keep Mexican wages below the wages of skilled labor in America. About 500,000 low wage factory jobs have been created in Mexico through Maquiladora. These jobs pay less than the American minimum wage. These low wages benefit corporations and their stockholders in the short term. They also help Mexico generate hard currency to pay it's international indebtedness.

For Maquiladora to function fairly with regard to the Mexican and American economies, the wages paid to Mexican workers must be set at par with the wages of American workers doing similar jobs. This doesn't suggest the same price per hour, but an equal hourly return based upon productivity. This side by side comparison demands that Mexican wages go up, rather than American wages coming down.

For Maquiladora to function fairly with regard to the Mexican and American economies, the wages paid to Mexican workers must be set at par with the wages of American workers doing similar jobs. This doesn't suggest the same price per hour, but an equal hourly return based upon productivity. This side by side comparison demands that Mexican wages go up, rather than American wages coming down.

Proponents of Maquiladora, and more recently, NAFTA, the North American Free Trade Agreement, boast of increased exports to Mexico. However, on close examination one finds that! most exports are permanent manufacturing equipment used by American businesses that move to Mexico or for components purchased in America and assembled into finished products in Mexico and then exported back to America.

Proponents of Maquiladora, and more recently, NAFTA, the North American Free Trade Agreement, boast of increased exports to Mexico. However, on close examination one finds that! most exports are permanent manufacturing equipment used by American businesses that move to Mexico or for components purchased in America and assembled into finished products in Mexico and then exported back to America.

In 1992, only 8 Billion Dollars of the 41 Billion Dollars of U.S. exports to Mexico were Mexican purchased American made consumer goods. Mexican workers can't buy expensive American consumer goods when their best jobs pay less than our U.S. minimum wage.

In 1992, only 8 Billion Dollars of the 41 Billion Dollars of U.S. exports to Mexico were Mexican purchased American made consumer goods. Mexican workers can't buy expensive American consumer goods when their best jobs pay less than our U.S. minimum wage.

FREE TRADE REQUIRES CULTURAL HOMOGENIZATION

If free trade is to become fair trade, America and her trading partners must prepare for a steady international homogenization of cultures, languages, currencies, and standards of living. Each of these factors may eventually erode the sovereignty of national boundaries.

If free trade is to become fair trade, America and her trading partners must prepare for a steady international homogenization of cultures, languages, currencies, and standards of living. Each of these factors may eventually erode the sovereignty of national boundaries.

(Personal Note)

A few year!s ago we traveled to Cuidad Obregon, Mexico along with several other persons in search of agriculture enterprises, and during our visit to a Mexican farm, two of our companions got into a friendly argument which had to be settled by, of all things, a foot race (we were all younger then). The race occurred on the bank of an irrigation canal. The older of the two runners twisted his ankle during the foot race and could hardly walk to the car.

A few year!s ago we traveled to Cuidad Obregon, Mexico along with several other persons in search of agriculture enterprises, and during our visit to a Mexican farm, two of our companions got into a friendly argument which had to be settled by, of all things, a foot race (we were all younger then). The race occurred on the bank of an irrigation canal. The older of the two runners twisted his ankle during the foot race and could hardly walk to the car.

Upon returning to our hotel in Cuidad Obregon, a hotel custodian noticed our friend was in pain, and carved him a walking cane from a discarded broom handle. The afflicted runner was grateful and gave the custodian a five dollar bill. Our Mexican hosts were extremely upset over the five dollar payment. It was against all protocol to give a member of the lowly working class five dollars for anything!

Upon returning to our hotel in Cuidad Obregon, a hotel custodian noticed our friend was in pain, and carved him a walking cane from a discarded broom handle. The afflicted runner was grateful and gave the custodian a five dollar bill. Our Mexican hosts were extremely upset over the five dollar payment. It was against all protocol to give a member of the lowly working class five dollars for anything!

While touring the area near Cuidad Obregon, we noticed a large area of slums a!bout a half mile outside the city. We asked our Mexican hosts to let us get a closer look. They refused. We learned later that the "slums" were the homes of working class people. These homes represented the average standard of living for the area.

While touring the area near Cuidad Obregon, we noticed a large area of slums a!bout a half mile outside the city. We asked our Mexican hosts to let us get a closer look. They refused. We learned later that the "slums" were the homes of working class people. These homes represented the average standard of living for the area.

On another trip we went to the east coast near Tampico, Mexico. We were looking at a large farm that was being cleared of brush. On one corner of the property, surrounding a stock pond, were small thatched shelters. The farm manager explained that farm workers were living in these make shift shelters. He said the farm owners dug the pond to collect rain water and the workers built shelters around the pond. The manager also showed us a small "company store" owned by the farm. The workers bought their food, liquor and other supplies from this store. As a result of this store, their labor income was recycled back through the farm.

On another trip we went to the east coast near Tampico, Mexico. We were looking at a large farm that was being cleared of brush. On one corner of the property, surrounding a stock pond, were small thatched shelters. The farm manager explained that farm workers were living in these make shift shelters. He said the farm owners dug the pond to collect rain water and the workers built shelters around the pond. The manager also showed us a small "company store" owned by the farm. The workers bought their food, liquor and other supplies from this store. As a result of this store, their labor income was recycled back through the farm.

These are honest examples of the culture gap that exists between two adjacent societies. The "gap" is just as evident when Americans interact with the Japanese.

These are honest examples of the culture gap that exists between two adjacent societies. The "gap" is just as evident when Americans interact with the Japanese.

On several occasions we acted as tour guides for groups of Japanese farm leaders and businessmen who were visiting America for the first time. They had all heard of Texas and its wide open spaces. They wanted to see it for themselves.

On several occasions we acted as tour guides for groups of Japanese farm leaders and businessmen who were visiting America for the first time. They had all heard of Texas and its wide open spaces. They wanted to see it for themselves.

On one such occasion, we met a group of Japanese men at the Austin airport and loaded them and our interpreter into a 15 seat van. We drove east into rural Travis and Williamson Counties where cotton, corn, wheat, and Milo blanket the country side. Our guests were amazed at the size and scope of the farming operations. They walked into several fields, and upon returning were obviously refreshed because they could look in every direction and see farms, but not people! They were in awe of the open space.

On one such occasion, we met a group of Japanese men at the Austin airport and loaded them and our interpreter into a 15 seat van. We drove east into rural Travis and Williamson Counties where cotton, corn, wheat, and Milo blanket the country side. Our guests were amazed at the size and scope of the farming operations. They walked into several fields, and upon returning were obviously refreshed because they could look in every direction and see farms, but not people! They were in awe of the open space.

Ironically, by American standards, the blackland farms located east of Austin, Texas are small. These farms, first settled by Czech, German and Swedish immigrants during the late 1800's, remain in units of only 100 acres or less, 1/20th the size necessary to support a modern American farm operation.

Ironically, by American standards, the blackland farms located east of Austin, Texas are small. These farms, first settled by Czech, German and Swedish immigrants during the late 1800's, remain in units of only 100 acres or less, 1/20th the size necessary to support a modern American farm operation.

That evening we took them to a cafe for a meal of hot sausage and barbequed beef. None of these men had ever eaten such a meal. Afterward, they ordered several extra pitchers of ice water and politely insisted that spicy beef was an acquired taste.

That evening we took them to a cafe for a meal of hot sausage and barbequed beef. None of these men had ever eaten such a meal. Afterward, they ordered several extra pitchers of ice water and politely insisted that spicy beef was an acquired taste.

Throughout the years and the business deals, we've had similar awkward encounters with the English, French, and others. Except for the Canadians, the differences were more apparent than the similarities.

Throughout the years and the business deals, we've had similar awkward encounters with the English, French, and others. Except for the Canadians, the differences were more apparent than the similarities.

These "people differences" are cultural and economic differences that make free trade difficult and many times exploitive. It's unrealistic to believe that free trade can occur simply by signing treaties written in !a language that must be proof read for each government official by interpreters.

These "people differences" are cultural and economic differences that make free trade difficult and many times exploitive. It's unrealistic to believe that free trade can occur simply by signing treaties written in !a language that must be proof read for each government official by interpreters.

America's unilateral free trade policy has ignored the cultural and economic differences of trading partners. The resulting trade deficits reflect a trading policy that has imposed unnecessary hardship on labor in America and the labor force of many developing countries.

America's unilateral free trade policy has ignored the cultural and economic differences of trading partners. The resulting trade deficits reflect a trading policy that has imposed unnecessary hardship on labor in America and the labor force of many developing countries.

UNFAIR TRADE CREATES UNEMPLOYMENT

Fair international trade must be based upon an equitable exchange of labor values. Please review the percent of National Income that's used in America to pay wages, salaries and supplements to wages to better understand the arithmetic surrounding fair international trade agreements.

Fair international trade must be based upon an equitable exchange of labor values. Please review the percent of National Income that's used in America to pay wages, salaries and supplements to wages to better understand the arithmetic surrounding fair international trade agreements.

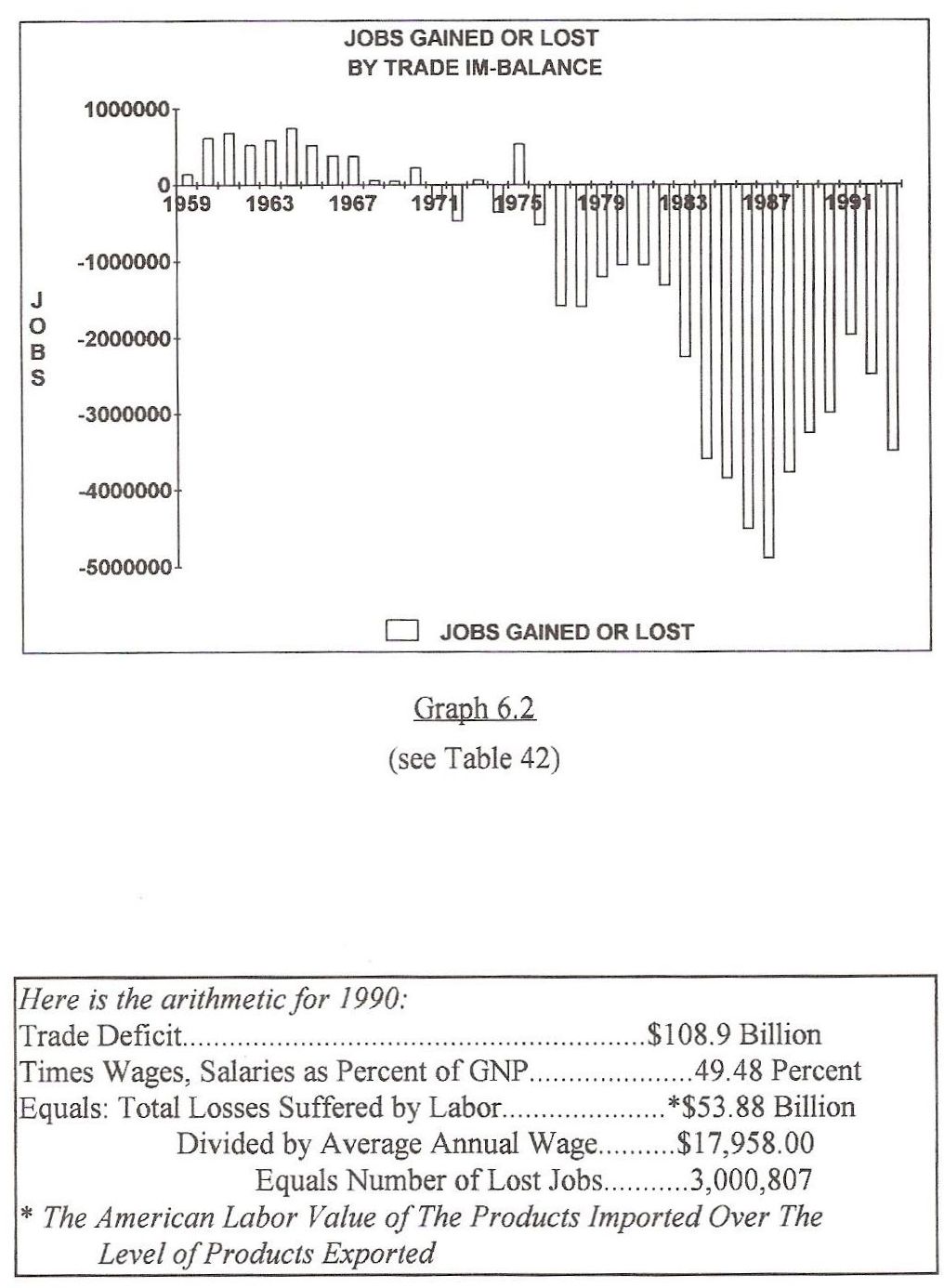

For this exercise, determine the percentage of Gross National Product (GNP) attributable to wages and salaries for any year. Then, by using average wages paid to workers as a divisor, quantify the effects of trade imbalances on America's domestic work force.

For this exercise, determine the percentage of Gross National Product (GNP) attributable to wages and salaries for any year. Then, by using average wages paid to workers as a divisor, quantify the effects of trade imbalances on America's domestic work force.

The year 1990 offers a representative example. That year, wages and salaries totaled 49.4% of the total GNP and the trade deficit was 108.9 Billion Dollars. So, trade deficits removed 49.4% of 108.9 Billion Dollars from wages and salaries. This money should have paid workers to produce products in America. This lost labor money translated into 3 million lost skilled jobs in 1990. Graph 6.2 tells the story.

The year 1990 offers a representative example. That year, wages and salaries totaled 49.4% of the total GNP and the trade deficit was 108.9 Billion Dollars. So, trade deficits removed 49.4% of 108.9 Billion Dollars from wages and salaries. This money should have paid workers to produce products in America. This lost labor money translated into 3 million lost skilled jobs in 1990. Graph 6.2 tells the story.

Graph 6.2

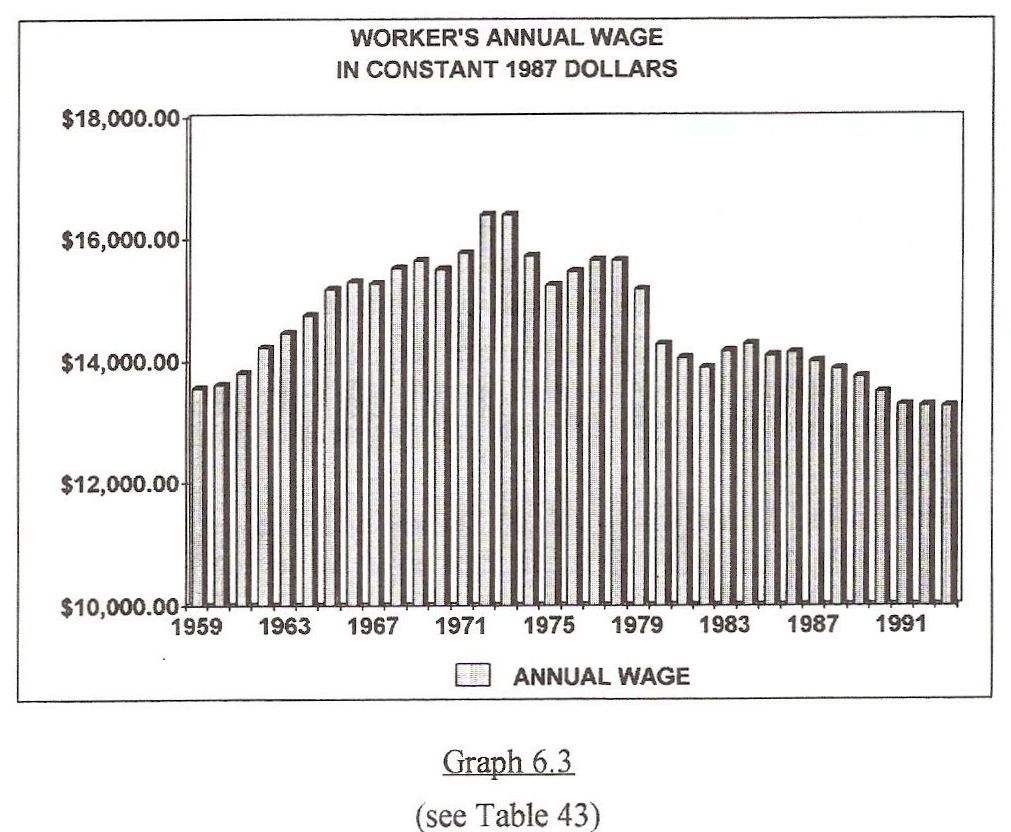

Graph 6.3

Graph 6.3 displays average American wages in constant dollars. The graph reflects substantial declines in the real purchasing power of labor since the 1970's.

Graph 6.3 displays average American wages in constant dollars. The graph reflects substantial declines in the real purchasing power of labor since the 1970's.

Labor's attempt to maintain purchasing power is being eroded because international trades have exported unemployment to America. This creates an artificial surplus of labor in America through foreign trade. T!his is certainly the case with Japan. The unfair business incentives created by the Maquiladora program and institutionalized by the NAFTA agreement maintain a similar situation with Mexico.

Labor's attempt to maintain purchasing power is being eroded because international trades have exported unemployment to America. This creates an artificial surplus of labor in America through foreign trade. T!his is certainly the case with Japan. The unfair business incentives created by the Maquiladora program and institutionalized by the NAFTA agreement maintain a similar situation with Mexico.

The results are, average American wages, when calculated in constant dollars, have returned to the levels of the 1950's.

The results are, average American wages, when calculated in constant dollars, have returned to the levels of the 1950's.

This lost consumer income causes predatory competitiveness by business. This leads to more downward pressure on business profits. A syndrome is then created that causes even more American companies to move facilities to Mexico or to other countries where they can find the sanctuary of low wages and no regulation.

This lost consumer income causes predatory competitiveness by business. This leads to more downward pressure on business profits. A syndrome is then created that causes even more American companies to move facilities to Mexico or to other countries where they can find the sanctuary of low wages and no regulation.

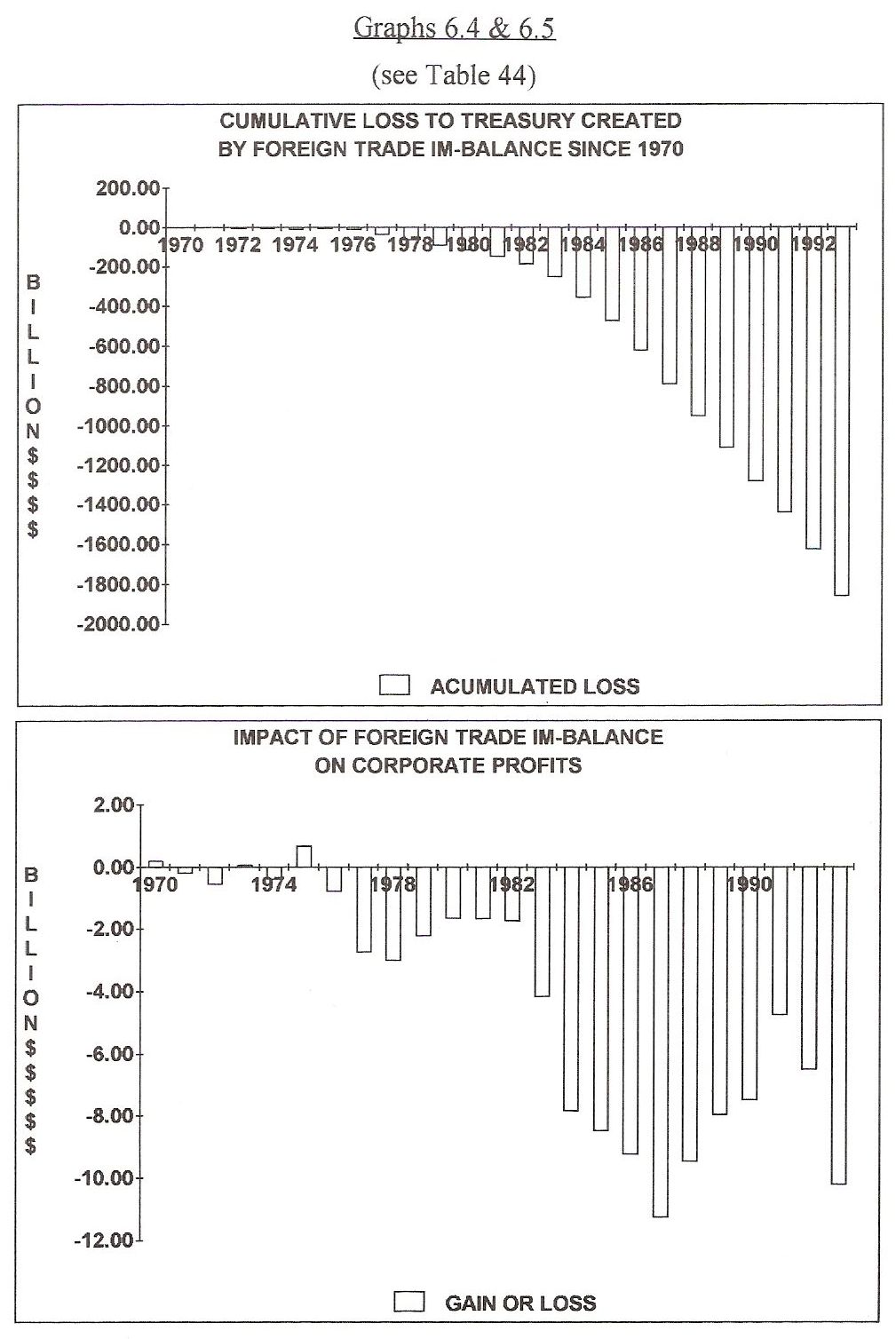

The forthcoming Tables and Graphs examine the trade deficit as it affects corporate profits, job creation, Treasury collections and the public debt. To produce this analysis, the economy was divided into the affected segments to quantify the percentage lost by each segment.

The forthcoming Tables and Graphs examine the trade deficit as it affects corporate profits, job creation, Treasury collections and the public debt. To produce this analysis, the economy was divided into the affected segments to quantify the percentage lost by each segment.

In 1993, a 140 Billion Dollar trade imbalance cost the economy 4.66 Billion Dollars in lost corporate profits, and 3,489,582 jobs each paying an average $19,429.28 per year. This is the average wage paid to American Workers.

In 1993, a 140 Billion Dollar trade imbalance cost the economy 4.66 Billion Dollars in lost corporate profits, and 3,489,582 jobs each paying an average $19,429.28 per year. This is the average wage paid to American Workers.

It cost the Treasury 103 Billion Dollars in lost taxes (IRS only), further reducing treasury receipts. In fact, over 1/3 of the public debt can be traced to the taxes lost on trade deficits!

It cost the Treasury 103 Billion Dollars in lost taxes (IRS only), further reducing treasury receipts. In fact, over 1/3 of the public debt can be traced to the taxes lost on trade deficits!

Graphs 6.4 & 6.5

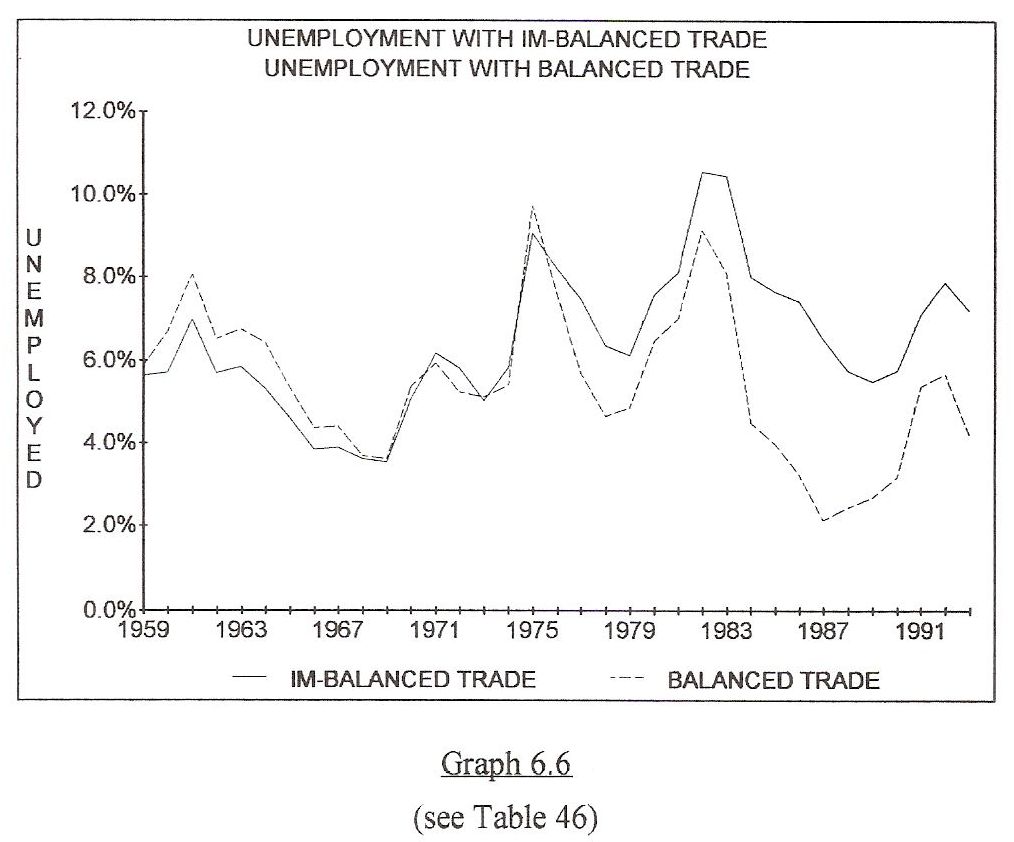

Graph 6.6

Graph 6.6 is the final exercise in this series. It displays the unemployment rate with the trade deficit and a hypothetical unemployment rate without a trade deficit.

Graph 6.6 is the final exercise in this series. It displays the unemployment rate with the trade deficit and a hypothetical unemployment rate without a trade deficit.

The AFL/CIO complains about unfair trade as a reason for increased unemployment. Graph 6.6 tests labor's claim.

The AFL/CIO complains about unfair trade as a reason for increased unemployment. Graph 6.6 tests labor's claim.

In 1993, 48.43% of GNP was wages & salaries. This percentage excludes supplements to wages. In 1993, America suffered from a trade deficit of 140 Billion Dollars. Therefore, 48.43% of the trade deficit can be categorized as the lost take home pay or lost labor value due to excessive imports.

In 1993, 48.43% of GNP was wages & salaries. This percentage excludes supplements to wages. In 1993, America suffered from a trade deficit of 140 Billion Dollars. Therefore, 48.43% of the trade deficit can be categorized as the lost take home pay or lost labor value due to excessive imports.

The average wage for 1993 was $19,429.28 per year. So, the jobs lost during 1993 due to the trade deficit totaled 3,489,582 out of a work force of 121 million. This raised unemployment from 4.2% to 7.2%, which is the distance between the two lines on Graph 6.6.

The average wage for 1993 was $19,429.28 per year. So, the jobs lost during 1993 due to the trade deficit totaled 3,489,582 out of a work force of 121 million. This raised unemployment from 4.2% to 7.2%, which is the distance between the two lines on Graph 6.6.

THE TAKE-HOME PAY OF LABOR and

THE "TEMPORARY" McJOBS MARKET

Table 48 examines wages, salaries & supplements. It appears that business is paying an increasing percentage of National Income each year to labor. But, the AFL-CIO says it attempts to maintain wage increases at par with the inflation rate.

Table 48 examines wages, salaries & supplements. It appears that business is paying an increasing percentage of National Income each year to labor. But, the AFL-CIO says it attempts to maintain wage increases at par with the inflation rate.

If supplements to wages and salaries in Column F are separated from (the total of wages, salaries and supplements to wages in Column B) one learns in Column E, that since WWII, an average of approximately 62% of National Income has consistently been paid to wages and salaries, or to the "take home" pay of labor. This percentage remained relatively stable during the entire period.

If supplements to wages and salaries in Column F are separated from (the total of wages, salaries and supplements to wages in Column B) one learns in Column E, that since WWII, an average of approximately 62% of National Income has consistently been paid to wages and salaries, or to the "take home" pay of labor. This percentage remained relatively stable during the entire period.

The supplements to wages and salaries that include health care benefits and pension plans have increased dramatically, but they should be considered as desirable attempts by a society to protect the well being of future generations.

The supplements to wages and salaries that include health care benefits and pension plans have increased dramatically, but they should be considered as desirable attempts by a society to protect the well being of future generations.

The reliance on supplements is exacerbated by economic structural imbalances which artificially depress wages below a level of family self sufficiency. However, the economy will further stratify if proper ratios of cost to profits are re-established by reducing or eliminating wage supplements. Instead, balance must be restored by increasing raw material prices to a level at par with consumer goods.

The reliance on supplements is exacerbated by economic structural imbalances which artificially depress wages below a level of family self sufficiency. However, the economy will further stratify if proper ratios of cost to profits are re-established by reducing or eliminating wage supplements. Instead, balance must be restored by increasing raw material prices to a level at par with consumer goods.

Cheaper labor is a self defeating solution because cheap labor lowers the population's standard of living. Today, almost two million people are under-employed in the temporary jobs system. These people are paid low wages, they have no job security, and no health care benefits. This is the fastest growing jobs program in America, and it has very negative long term consequences.

Cheaper labor is a self defeating solution because cheap labor lowers the population's standard of living. Today, almost two million people are under-employed in the temporary jobs system. These people are paid low wages, they have no job security, and no health care benefits. This is the fastest growing jobs program in America, and it has very negative long term consequences.

The record reveals that regardless of temporary jobs, recessions, depressions, high unemployment, budget deficits or inflation, American labor has earned a consistent percentage of National Income since World War II while slowly improving basic health and lifestyle. However, labor's overall purchasing power has been declining in recent years because manufacturing jobs were exported while the service economy and temporary jobs were! over expanded.

The record reveals that regardless of temporary jobs, recessions, depressions, high unemployment, budget deficits or inflation, American labor has earned a consistent percentage of National Income since World War II while slowly improving basic health and lifestyle. However, labor's overall purchasing power has been declining in recent years because manufacturing jobs were exported while the service economy and temporary jobs were! over expanded.

Supplements to wages such as health care benefits and pension plans have increased the costs of labor to business, but this is no reason to load up the factory and leave America. An honest days pay for a honest days work is the foundation under America's standard of living, and is the core of the American promise. However, when the economy operates outside the normal perimeters of structural balance, it has no choice but to increase its percentage of unemployment or under-employment. When an economy remains out of internal balance for too long, wage rates deteriorate, private debt increases, unemployment becomes cemented in place, and public debt grows. The physical structure of the economy demands these reactions.

Supplements to wages such as health care benefits and pension plans have increased the costs of labor to business, but this is no reason to load up the factory and leave America. An honest days pay for a honest days work is the foundation under America's standard of living, and is the core of the American promise. However, when the economy operates outside the normal perimeters of structural balance, it has no choice but to increase its percentage of unemployment or under-employment. When an economy remains out of internal balance for too long, wage rates deteriorate, private debt increases, unemployment becomes cemented in place, and public debt grows. The physical structure of the economy demands these reactions.

Cutting wages and benefits only makes the ultimate economic pie smaller, not larger. Temporary jobs and unnecessary public works programs do nothing to eliminate the problem of economic structural imbalances.

Cutting wages and benefits only makes the ultimate economic pie smaller, not larger. Temporary jobs and unnecessary public works programs do nothing to eliminate the problem of economic structural imbalances.

Henry Ford knew that cheap wages made cheap people and a poor country. He proved it by raising wages to an unprecedented level so his factory workers could afford to buy new Ford Model T cars. This piece of history must not be forgotten.

Henry Ford knew that cheap wages made cheap people and a poor country. He proved it by raising wages to an unprecedented level so his factory workers could afford to buy new Ford Model T cars. This piece of history must not be forgotten.

The consistency of wages and salaries as a percentage of National Income speaks to the existence of predictability within the private enterprise system if reasonable steps are taken to protect the most important segments of the economy. The profits of the private enterprise (as will be demonstrated) can also be protected as trade and domestic commerce is increased without destroying the relative economic position of workers or businesses.

The consistency of wages and salaries as a percentage of National Income speaks to the existence of predictability within the private enterprise system if reasonable steps are taken to protect the most important segments of the economy. The profits of the private enterprise (as will be demonstrated) can also be protected as trade and domestic commerce is increased without destroying the relative economic position of workers or businesses.

Conventional wisdom says that increased international trade automatically means cheaper retail prices and trade imbalances. However, the two are only synonymous today because international trade agreements don't maintain structural balance within the American economy, and they discourage the development of a structurally balanced economy in other nations. Bad trade agreements can be defined as agreements that abuse debt based currencies and do nothing to protect American jobs.

Conventional wisdom says that increased international trade automatically means cheaper retail prices and trade imbalances. However, the two are only synonymous today because international trade agreements don't maintain structural balance within the American economy, and they discourage the development of a structurally balanced economy in other nations. Bad trade agreements can be defined as agreements that abuse debt based currencies and do nothing to protect American jobs.

Fair trade, in a free international trading environment, can only occur if both trading partners earn equitable amounts of labor value per unit of production from items produced at parallel positions in their domestic production cycles. Any other basis for international exchange automatically exploits the labor force of one or the other nation engaged in the trade.

Fair trade, in a free international trading environment, can only occur if both trading partners earn equitable amounts of labor value per unit of production from items produced at parallel positions in their domestic production cycles. Any other basis for international exchange automatically exploits the labor force of one or the other nation engaged in the trade.

If free trade is to be fair trade, both trading partners must exchange products or services at the par labor value of each trading partner. If this occurs, both partners to the exchange will generate optimum domestic distribution from the transaction and thus the aggregate volume of trade will be increased consistent with the real need for the goods exchanged. Thus, if fair trade replaces free trade, neither society involved in the exchange will be exploited in the process.

If free trade is to be fair trade, both trading partners must exchange products or services at the par labor value of each trading partner. If this occurs, both partners to the exchange will generate optimum domestic distribution from the transaction and thus the aggregate volume of trade will be increased consistent with the real need for the goods exchanged. Thus, if fair trade replaces free trade, neither society involved in the exchange will be exploited in the process.

This fairness formula prevents the wealthier trading partner from exploiting the labor force of the poorer partner, and it removes the incentives from the poorer partner to exploit the higher price level in the wealthier nation. Thus it removes most of the trade incentives from both partners and causes more items of commerce to be produced domestically from available raw materials and labor.

This fairness formula prevents the wealthier trading partner from exploiting the labor force of the poorer partner, and it removes the incentives from the poorer partner to exploit the higher price level in the wealthier nation. Thus it removes most of the trade incentives from both partners and causes more items of commerce to be produced domestically from available raw materials and labor.

These redirected domestic incentives will build the infrastructure of third world societies and protect American jobs. They must replace the current misdirected desire for increased international trade, or Franklin's second method of wealth accumulation will stand.

These redirected domestic incentives will build the infrastructure of third world societies and protect American jobs. They must replace the current misdirected desire for increased international trade, or Franklin's second method of wealth accumulation will stand.

A Brief History Of American Customs Duties And International Trade

Based on a report published by Dr. John Lee Coulter on April 1, 1945.

It has been updated with data from: Statistical Abstracts of the United States from Colonial Times to 1992

During colonial days, the separate American colonies collected revenue for their use and contributed to the mother country largely through the imposition of customs duties. It is not surprising that with the Declaration of Independence, each of the several colonies continued to prescribe customs duties on imported commodities as a source of revenue. In those early days, financial support for local units (counties, parishes, cities, towns, school districts, road districts, etc.) was derived chiefly from local real property and/or personal property taxes supplemented by excises and other charges imposed for services rendered.

During colonial days, the separate American colonies collected revenue for their use and contributed to the mother country largely through the imposition of customs duties. It is not surprising that with the Declaration of Independence, each of the several colonies continued to prescribe customs duties on imported commodities as a source of revenue. In those early days, financial support for local units (counties, parishes, cities, towns, school districts, road districts, etc.) was derived chiefly from local real property and/or personal property taxes supplemented by excises and other charges imposed for services rendered.

With the formation of the national government, it was necessary to create a source of revenue for that national government. Widespread discussion extended from 1775 to 1787, but it was finally decided that each of the 13 original states would surrender all claims to customs duties (whether imposed upon imports from foreign areas or duties from the movement of goods between states). It was agreed that absolute freedom of movement of persons and property (including commodities of every kind) would be maintained between the states and no state would impose import or export duties on another state. It was also agreed that imports of commodities from foreign areas, would be subject to customs duties by the national government. It was provided, however, that there should never be imposed, any export duty or tariff on any commodity from any state exported to foreign areas. Customs duties imposed by the federal government were intended to provide substantially all the revenue required by the national government.

With the formation of the national government, it was necessary to create a source of revenue for that national government. Widespread discussion extended from 1775 to 1787, but it was finally decided that each of the 13 original states would surrender all claims to customs duties (whether imposed upon imports from foreign areas or duties from the movement of goods between states). It was agreed that absolute freedom of movement of persons and property (including commodities of every kind) would be maintained between the states and no state would impose import or export duties on another state. It was also agreed that imports of commodities from foreign areas, would be subject to customs duties by the national government. It was provided, however, that there should never be imposed, any export duty or tariff on any commodity from any state exported to foreign areas. Customs duties imposed by the federal government were intended to provide substantially all the revenue required by the national government.

One of the first acts of the first Congress which convened in New York City on March 4, 1789 was to provide for the national revenue. The act imposed tonnage taxes on imported commodities.

One of the first acts of the first Congress which convened in New York City on March 4, 1789 was to provide for the national revenue. The act imposed tonnage taxes on imported commodities.

During the first decade 1791-1800 the total revenue for the United States Government averaged $6,764,000 annually and consisted of the following items:

During the first decade 1791-1800 the total revenue for the United States Government averaged $6,764,000 annually and consisted of the following items:

Customs duties (including tonnage taxes)..........$5,940,000

Customs duties (including tonnage taxes)..........$5,940,000

Internal revenue (imposts and excises).....................440,000

Internal revenue (imposts and excises).....................440,000

Sales of public lands.....................................................10,000

Sales of public lands.....................................................10,000

Surplus postal receipts.................................................36,000

Surplus postal receipts.................................................36,000

Miscellaneous receipts.............................................. 334,000

Miscellaneous receipts.............................................. 334,000

(Average annual)..$6,764,000

(Average annual)..$6,764,000

Customs duties (including tonnage taxes) provided 90% of the revenue required by the original national government.

Customs duties (including tonnage taxes) provided 90% of the revenue required by the original national government.

Customs duties also played an important role during the next century (1800-1900). During the 60 years 1800-1860 (up to the outbreak of the war between the states) total national revenue collected amounted to $1,752,540,000 (1.75 Billion Dollars), and of that total, $1,488,980,000 (1.48 Billion Dollars), or about 90% was derived from customs duties. Much of the remaining 10% came from the sale of public lands, because the free land or the homestead system did not become the policy of the nation until the early 1860's.

Incidentally, customs duties were sufficient to liquidate much of the indebtedness of the Revolutionary War, the costs of the Indian Wars, the Louisiana Purchase, the War of 1812-1816, the acquisition of Florida, and the Mexican War.

Incidentally, customs duties were sufficient to liquidate much of the indebtedness of the Revolutionary War, the costs of the Indian Wars, the Louisiana Purchase, the War of 1812-1816, the acquisition of Florida, and the Mexican War.

During that period, revenue collected from customs duties provided the large sums needed for internal improvements, - the highways, canals and other enterprises supported by the national government.

During that period, revenue collected from customs duties provided the large sums needed for internal improvements, - the highways, canals and other enterprises supported by the national government.

Customs duties provided almost all revenue for the national government and provided protection for the new industries that would free America from the exploitation of established foreign industrial groups.

Customs duties provided almost all revenue for the national government and provided protection for the new industries that would free America from the exploitation of established foreign industrial groups.

The collection of large amounts of internal revenue from excise taxes and from income, including profits taxes, paid about 50% of the cost of the war between the States. During the period following the Civil War (1861-1910), customs duties provided about 50% of the ordinary revenue of the national government; customs duties paid 40% during the 5 years preceding World War I (1911-1915); and only about 6.5% during the general period of the First World War (1916-1922). During the decade 1923-1932 customs duties provided about 14.2% of the total ordinary revenues, while during the decade 1933-1942 they again provided only about 6.5%. In 1994, only 17 Billion Dollars of these import taxes are collected for a federal budget of about 1.5 Trillion Dollars, or only 1,1%! (one & one/tenth percent). The following table summarizes these relationships during various periods of history.

The collection of large amounts of internal revenue from excise taxes and from income, including profits taxes, paid about 50% of the cost of the war between the States. During the period following the Civil War (1861-1910), customs duties provided about 50% of the ordinary revenue of the national government; customs duties paid 40% during the 5 years preceding World War I (1911-1915); and only about 6.5% during the general period of the First World War (1916-1922). During the decade 1923-1932 customs duties provided about 14.2% of the total ordinary revenues, while during the decade 1933-1942 they again provided only about 6.5%. In 1994, only 17 Billion Dollars of these import taxes are collected for a federal budget of about 1.5 Trillion Dollars, or only 1,1%! (one & one/tenth percent). The following table summarizes these relationships during various periods of history.

Table "Duties" in the Appendix presents details for most years from 1821 through 1993.

Table "Duties" in the Appendix presents details for most years from 1821 through 1993.

DUTIES COLLECTED AS A PERCENTAGE

OF TOTAL ORDINARY REVENUES, 1811-1992

Average annual revenue ($1,000)

Total Ordinary

Total Ordinary

Customs

Customs of Ordinary

of Ordinary

1801-1810

13,056

13,056

12,046

12,046

92.2

92.2

1811-1860

32,421

32,421

27,370

27,370

84.4

84.4

1861-1910

394,933

394,933

193,187

193,187

48.9

48.9

--------------------------------------------------------------------------------------

1911-1915

710,227

710,227

28!9,363

28!9,363

40.7

40.7

1916-1922

3,878,900

3,878,900

255,930

255,930

6.5

6.5

---------------------------------------------------------------------------------------

1923-1932

3,734,038

3,734,038

530,442

530,442

14.2

14.2

1933-1942

5,495,234

5,495,234

358,819

358,819

6.5

6.5

1943-1952

42,890,000

42,890,000

450,000

450,000

1.1

1.1

1953-1962

80,480,000

80,480,000

843,500

843,500

1.1

1.1

1963-1972

154,270,000

154,270,000 2,113,500

2,113,500

1.4

1.4

1973-1982

402,390,000

402,390,000 5,872,000

5,872,000

1.5

1.5

1983-1992

870,020,000

870,020,000 14,262,400

14,262,400

1.6

1.6

Rate of Duty Imposed on Dutiable Imports

Most people believe that an exorbitant rate of duty was imposed on imports during the early days of the Republic, in order to provide all revenue required for the national government. During the !entire century of 1800 to 1900, the rate of duty "on dutiable commodities" averaged about 40 percent. During the decade 1821-1830 the ratio of customs duties to "foreign invoice values of dutiable commodities" was 49.20 percent, while during the last decade of the 19th century the average was 47.02 percent. During the period from 1900 to the end of WWII, the average rate of duty imposed "on the foreign invoice value of dutiable imports" ranged between 40 percent and 50 percent. In 1992, the overall rate of duty was 5.2% and was collected on 65.9% of imports.

Most people believe that an exorbitant rate of duty was imposed on imports during the early days of the Republic, in order to provide all revenue required for the national government. During the !entire century of 1800 to 1900, the rate of duty "on dutiable commodities" averaged about 40 percent. During the decade 1821-1830 the ratio of customs duties to "foreign invoice values of dutiable commodities" was 49.20 percent, while during the last decade of the 19th century the average was 47.02 percent. During the period from 1900 to the end of WWII, the average rate of duty imposed "on the foreign invoice value of dutiable imports" ranged between 40 percent and 50 percent. In 1992, the overall rate of duty was 5.2% and was collected on 65.9% of imports.

Most foreign countries continue to impose taxes on the value of imported commodities "at the place and at the time of importation." There is nothing wrong with this procedure. It is a method to protect the value of domestic business and labor.

Most foreign countries continue to impose taxes on the value of imported commodities "at the place and at the time of importation." There is nothing wrong with this procedure. It is a method to protect the value of domestic business and labor.

During the decade 1821-1!830, only 5.86% of all imports to America were free of duty, whereas by 1891-1900 the portion admitted free of duty had increased to 59.54%. In other words, the percentage of imports subject to duties decreased from about 94% of all imports to 40% of all imports from the beginning of the 19th century to the beginning of the 20th century. By 1950, this percentage increased to 58.8%. In 1992 the percentage dropped to 34.1%, but the amount of duty per item had become insignificant.

During the decade 1821-1!830, only 5.86% of all imports to America were free of duty, whereas by 1891-1900 the portion admitted free of duty had increased to 59.54%. In other words, the percentage of imports subject to duties decreased from about 94% of all imports to 40% of all imports from the beginning of the 19th century to the beginning of the 20th century. By 1950, this percentage increased to 58.8%. In 1992 the percentage dropped to 34.1%, but the amount of duty per item had become insignificant.

Imports Entered Free of Duty

During the century of 1800 to 1900, the people of the United States increased the list of duty free items on practically every occasion when the subject of national revenue came up for consideration. "The free list" was and is the most outstanding feature of American trade policy.

During the century of 1800 to 1900, the people of the United States increased the list of duty free items on practically every occasion when the subject of national revenue came up for consideration. "The free list" was and is the most outstanding feature of American trade policy.

The trade policy of the United States has always leaned toward exempting commodities !not successfully produced in sufficient quantity in the United States. This works in opposition to the domestic development of the needed commodity. In more recent years, this same policy applied to things America produced in abundance. This keeps prices low for crude oil, farm crops and other raw materials. It also intimidates labor.

The trade policy of the United States has always leaned toward exempting commodities !not successfully produced in sufficient quantity in the United States. This works in opposition to the domestic development of the needed commodity. In more recent years, this same policy applied to things America produced in abundance. This keeps prices low for crude oil, farm crops and other raw materials. It also intimidates labor.

Customs Duties Collected Per Capita of Population

Over a hundred and fifty years ago, during the decade 1821-1830, duties collected per capita of American population averaged $2.32 per annum, whereas during the years prior to WWII, 1938-1939-1940, duties per capita averaged almost the same amount or $2.37.

Over a hundred and fifty years ago, during the decade 1821-1830, duties collected per capita of American population averaged $2.32 per annum, whereas during the years prior to WWII, 1938-1939-1940, duties per capita averaged almost the same amount or $2.37.

For more than a century, the rate of duty on dutiable imports was generally maintained at between 40% and 50% in terms of foreign invoice value, and the proportion of all imports that entered free of duty was increased from about 6% to 66%. At the same time, the amount of duties collected averaged about $2.50 per capita per annum at the beginning and at the end of the 150 year period. In 1992, due to inflation and high levels of imports, the per capita per annum duty is $67.10.

For more than a century, the rate of duty on dutiable imports was generally maintained at between 40% and 50% in terms of foreign invoice value, and the proportion of all imports that entered free of duty was increased from about 6% to 66%. At the same time, the amount of duties collected averaged about $2.50 per capita per annum at the beginning and at the end of the 150 year period. In 1992, due to inflation and high levels of imports, the per capita per annum duty is $67.10.

Special emphasis must be placed upon the fact that total duties collected in 1821-1830 represented 46.31% of the value of "all goods imported." At the beginning of WWII, the percentage fell to 13.59%, primarily because of the tremendous portion of imports which entered free of duty during the previous decade. In 1992, duties collected total only about 3% of the value of all imports.

Special emphasis must be placed upon the fact that total duties collected in 1821-1830 represented 46.31% of the value of "all goods imported." At the beginning of WWII, the percentage fell to 13.59%, primarily because of the tremendous portion of imports which entered free of duty during the previous decade. In 1992, duties collected total only about 3% of the value of all imports.

Raw Materials Economics eliminates trade disparities by imposing only the amount of import tax necessary to offset monetary and labor efficiency differentials between nations.

Raw Materials Economics eliminates trade disparities by imposing only the amount of import tax necessary to offset monetary and labor efficiency differentials between nations.

The following table presents a picture of duties by decades and five year periods.

The following table presents a picture of duties by decades and five year periods.

The GATT in the Hat

The Trade Deal's "Magic" Could Make World Prosperity Disappear

This article by Sir James Goldsmith appeared in the editorial section of the Washington Post in September of 1994. It is reprinted here because it summarizes NORM's concerns about the long term consequences of GATT. Sir James Goldsmith is an international financier who has recently been elected to the European Parliament from France.

It is extraordinary that the General Agreement of Tariffs and Trade (GATT), the instrument of global free trade, could have been negotiated by successive U.S. administrations without a full public and national debate. In the closing days of the 103rd Congress, the Clinton administration hopes to push through the latest set of multilateral trade agreements under GATT, the so-called Uruguay Round, the most ambitious to date.

It is extraordinary that the General Agreement of Tariffs and Trade (GATT), the instrument of global free trade, could have been negotiated by successive U.S. administrations without a full public and national debate. In the closing days of the 103rd Congress, the Clinton administration hopes to push through the latest set of multilateral trade agreements under GATT, the so-called Uruguay Round, the most ambitious to date.

By contrast, the North American Free Trade Agreement (NAFTA) was the subject of substantial and reasonably well-informed debate -- yet NAFTA is insignificant compared to GATT. If fully successful, GATT - and its successor, the World Trade Organization, to be established by the Uruguay Round agreement -- will ultimately create a free trade area not just with America's neighbors, Mexico and Canada, but with China, India, Vietnam, Bangladesh, indeed the whole world. It is impossible to conceive of an international agreement with deeper and more widespread social consequences. The American public cannot afford to let its collective eyes glaze over at the mention of GATT.

By contrast, the North American Free Trade Agreement (NAFTA) was the subject of substantial and reasonably well-informed debate -- yet NAFTA is insignificant compared to GATT. If fully successful, GATT - and its successor, the World Trade Organization, to be established by the Uruguay Round agreement -- will ultimately create a free trade area not just with America's neighbors, Mexico and Canada, but with China, India, Vietnam, Bangladesh, indeed the whole world. It is impossible to conceive of an international agreement with deeper and more widespread social consequences. The American public cannot afford to let its collective eyes glaze over at the mention of GATT.

In no sector will the social and economic consequences be more far reaching than in agriculture. A principal purpose of GATT is to recast the world's agriculture in the name of efficiency and increased agricultural "productivity." Modern economists, more particularly those in favor of global trade, claim that the best agricultural system is the one that produces the maximum amount of food for the minimum price and employs the least number of people. But even in purely economic terms, that calculation is incomplete.

In no sector will the social and economic consequences be more far reaching than in agriculture. A principal purpose of GATT is to recast the world's agriculture in the name of efficiency and increased agricultural "productivity." Modern economists, more particularly those in favor of global trade, claim that the best agricultural system is the one that produces the maximum amount of food for the minimum price and employs the least number of people. But even in purely economic terms, that calculation is incomplete.

When you reduce the number of people employed on the land, those who become redundant are forced into cities. Therefore, you must add to the direct cost of producing food by intensive methods, the indirect costs of those who have been uprooted. As there are insufficient nonagricultural jobs throughout the world, there will be increased unemployment, with the consequent costs of welfare. As there is insufficient urban infrastructure, such as schools, hospitals an!d housing, there will be a need for substantial new capital expenditure.

When you reduce the number of people employed on the land, those who become redundant are forced into cities. Therefore, you must add to the direct cost of producing food by intensive methods, the indirect costs of those who have been uprooted. As there are insufficient nonagricultural jobs throughout the world, there will be increased unemployment, with the consequent costs of welfare. As there is insufficient urban infrastructure, such as schools, hospitals an!d housing, there will be a need for substantial new capital expenditure.

Yet there is a deeper price. In a stable society when, as a result of changes in technology, some jobs are lost in a particular industry, the fundamental balance of society is not altered. Some declining enterprises necessarily suffer while other, more competitive, entities emerge. But loss of rural employment and migration from the countryside to the cities causes a fundamental and irreversible change. It has contributed to the destabilization of rural society and the growth of vast urban concentrations from the First World to the Third. Within these huge urban groupings resides an alienated underclass whose traditions have been extinguished and whose families have been reduced to dependency on public and private charity.

Yet there is a deeper price. In a stable society when, as a result of changes in technology, some jobs are lost in a particular industry, the fundamental balance of society is not altered. Some declining enterprises necessarily suffer while other, more competitive, entities emerge. But loss of rural employment and migration from the countryside to the cities causes a fundamental and irreversible change. It has contributed to the destabilization of rural society and the growth of vast urban concentrations from the First World to the Third. Within these huge urban groupings resides an alienated underclass whose traditions have been extinguished and whose families have been reduced to dependency on public and private charity.

The cost of contributing to such social breakdown cannot be measured. As Jose Lutzenberger, the far-sighted former minister of the environment of Brazil, reminds us, the notorious slums of Brazil, known as favelas, were the direct result of the rural dislocations caused by the "green revolution" of the 1950's, which through intensive farming, was supposed to end for all time famine throughout the world.

The cost of contributing to such social breakdown cannot be measured. As Jose Lutzenberger, the far-sighted former minister of the environment of Brazil, reminds us, the notorious slums of Brazil, known as favelas, were the direct result of the rural dislocations caused by the "green revolution" of the 1950's, which through intensive farming, was supposed to end for all time famine throughout the world.

Maximizing agricultural output per person might have been an important consideration in the highly developed Western nations in which the cost of labor was great and standards of living were high. But we are entering a new world. Four billion people suddenly are joining the world economy. Until recently they had been held separate by their political systems, usually communist or socialist. They include the populations of China, India, Vietnam, Bangladesh and countries of the ex-Soviet Union among others. Their populations are growing fast and it is forecast that they will reach 6.5 billion in 35 years.

Maximizing agricultural output per person might have been an important consideration in the highly developed Western nations in which the cost of labor was great and standards of living were high. But we are entering a new world. Four billion people suddenly are joining the world economy. Until recently they had been held separate by their political systems, usually communist or socialist. They include the populations of China, India, Vietnam, Bangladesh and countries of the ex-Soviet Union among others. Their populations are growing fast and it is forecast that they will reach 6.5 billion in 35 years.

It is estimated that in the world there are still 3.1 billion people living in the countryside. If GATT succeeds in imposing worldwide the sort of productivity achieved by the intensive agriculture of Canada and Australia, then it is easy to calculate that approximately 2 billion of these people will lose their livelihood. Rural communities throughout the world will be uprooted and swept into urban slums. If many cannot find jobs in an expanded industrial sector, mass migrations of displaced and tragic peoples will follow. They will be the GATT refugees.

It is estimated that in the world there are still 3.1 billion people living in the countryside. If GATT succeeds in imposing worldwide the sort of productivity achieved by the intensive agriculture of Canada and Australia, then it is easy to calculate that approximately 2 billion of these people will lose their livelihood. Rural communities throughout the world will be uprooted and swept into urban slums. If many cannot find jobs in an expanded industrial sector, mass migrations of displaced and tragic peoples will follow. They will be the GATT refugees.

If global change is too vast to contemplate, consider the effects of GATT on one country. Vietnam is typical of the many nations making their first faltering steps toward joining the free world and the global economy. It has a population of 67 million of which 78 percent live in the countryside (compared to 14.8 in Australia, a major agricultural country). The current version of GATT would drive millions of poor Vietnamese from the fields into urban slums and create deep and long-la!sting devastation.

If global change is too vast to contemplate, consider the effects of GATT on one country. Vietnam is typical of the many nations making their first faltering steps toward joining the free world and the global economy. It has a population of 67 million of which 78 percent live in the countryside (compared to 14.8 in Australia, a major agricultural country). The current version of GATT would drive millions of poor Vietnamese from the fields into urban slums and create deep and long-la!sting devastation.

This fundamental flaw in global free trade is understood by the people of many Third World nations, if not in the halls of Congress. In India in March and October 1993 and again in April 1994, for example, hundreds of thousands of demonstrators have publicly opposed GATT.

This fundamental flaw in global free trade is understood by the people of many Third World nations, if not in the halls of Congress. In India in March and October 1993 and again in April 1994, for example, hundreds of thousands of demonstrators have publicly opposed GATT.

But GATT is not only of concern to landless Third World peasants. The developed world will suffer GATT-induced stresses of its own, in addition to the need to cope with refugee movements. The principle of global free trade is that anything can be manufactured anywhere in the world to be sold anywhere else. That means that the 4 billion new entrants into the world economy will be in direct competition with the work forces of the developed countries. This massive increase in the supply of extremely cheap labor is taking place at a time when technology can be transferred instantaneously anywhere in the world on the back of a microchip, and the capital is free to be invested worldwide wherever the anticipated yields are highest.

But GATT is not only of concern to landless Third World peasants. The developed world will suffer GATT-induced stresses of its own, in addition to the need to cope with refugee movements. The principle of global free trade is that anything can be manufactured anywhere in the world to be sold anywhere else. That means that the 4 billion new entrants into the world economy will be in direct competition with the work forces of the developed countries. This massive increase in the supply of extremely cheap labor is taking place at a time when technology can be transferred instantaneously anywhere in the world on the back of a microchip, and the capital is free to be invested worldwide wherever the anticipated yields are highest.

Some high tech industries can survive under these circumstances because they are highly automated. For them, labor is a minor item in the overall cost of their products. But as soon as they need to increase employment, they are forced to move offshore. For example, IBM is moving its disk-drive business from America and Western Europe to low-labor-cost countries. According to the Wall Street Journal, "IBM plans to establish this new site as a joint venture with an undetermined Asian partner and use non-IBM employees so that it will easier....to move to an even lower-cost region when warranted.....Moving from higher-cost regions to Asia cuts in half the cost of assembling the disk drive." Even so, said an IBM executive, "the moves will put IBM on only even footing with its competitors." Boeing has also announced it will transfer to China parts production for certain of its planes.

Some high tech industries can survive under these circumstances because they are highly automated. For them, labor is a minor item in the overall cost of their products. But as soon as they need to increase employment, they are forced to move offshore. For example, IBM is moving its disk-drive business from America and Western Europe to low-labor-cost countries. According to the Wall Street Journal, "IBM plans to establish this new site as a joint venture with an undetermined Asian partner and use non-IBM employees so that it will easier....to move to an even lower-cost region when warranted.....Moving from higher-cost regions to Asia cuts in half the cost of assembling the disk drive." Even so, said an IBM executive, "the moves will put IBM on only even footing with its competitors." Boeing has also announced it will transfer to China parts production for certain of its planes.

In France, proponents of global free trade claim that exporting such high tech products as very fast trains, airplanes and satellites will create jobs in a large scale. Alas, this is not true. The recent $2.1 billion contract selling high-speed French trains to South Korea will result in the maintenance for four years of only 800 jobs in France: 535 for the main supplier and 265 for the sub-contractors. Much of the work will be carried out in Korea employing Korean labor.

In France, proponents of global free trade claim that exporting such high tech products as very fast trains, airplanes and satellites will create jobs in a large scale. Alas, this is not true. The recent $2.1 billion contract selling high-speed French trains to South Korea will result in the maintenance for four years of only 800 jobs in France: 535 for the main supplier and 265 for the sub-contractors. Much of the work will be carried out in Korea employing Korean labor.

Supporters of global free trade argue that jobs in the service industries will replace lost employment in manufacturing. But even service industries will be subjected to substantial transfers of employment to low-cost areas. Today thorough satellites you can remain in constant contact with offices in distant lands. Swissair, for example, has recently transferred a significant part of its accounts department to India.

Supporters of global free trade argue that jobs in the service industries will replace lost employment in manufacturing. But even service industries will be subjected to substantial transfers of employment to low-cost areas. Today thorough satellites you can remain in constant contact with offices in distant lands. Swissair, for example, has recently transferred a significant part of its accounts department to India.

Developed !countries need to begin thinking about their balances of trade in terms of employment as well as money. If we export $1 billion of goods and import products of the same value, we now conclude that our overseas trade is in balance. But if our exports are heavily weighted toward high-tech products, while our imports are labor intensive, we are importing unemployment -- with large social costs not counted in the balance.

Developed !countries need to begin thinking about their balances of trade in terms of employment as well as money. If we export $1 billion of goods and import products of the same value, we now conclude that our overseas trade is in balance. But if our exports are heavily weighted toward high-tech products, while our imports are labor intensive, we are importing unemployment -- with large social costs not counted in the balance.

And global trade will not only increase unemployment in the developed world but exert downward pressure on wages because the value of labor will decline. Value-added is the increase of value obtained when you convert raw materials into a manufactured product. In a mature society such as our own, we have been able to develop -- through generations of political debate, elections, strikes, lockouts and other conflicts -- a general agreement as to how it should be shared between labor and capital. Global free trade will brutally shatter that agreement! .

And global trade will not only increase unemployment in the developed world but exert downward pressure on wages because the value of labor will decline. Value-added is the increase of value obtained when you convert raw materials into a manufactured product. In a mature society such as our own, we have been able to develop -- through generations of political debate, elections, strikes, lockouts and other conflicts -- a general agreement as to how it should be shared between labor and capital. Global free trade will brutally shatter that agreement! .

Nor should we expect that destroying employment and impoverishing the developed world will stabilize and enrich the population of the Third World. Let me quote an extract of a report by Herman Daly and Robert Goodland, published by the World Bank:

Nor should we expect that destroying employment and impoverishing the developed world will stabilize and enrich the population of the Third World. Let me quote an extract of a report by Herman Daly and Robert Goodland, published by the World Bank:

The "leveling of wages will be overwhelmingly downward due to the vast number and rapid growth rate of under-employed populations in the Third World. Northern laborers will get poorer, while Southern laborers will stay much the same."

Of course, there will be those who will benefit from these extraordinary changes -- principally, companies with access to an almost inexhaustible supply of very cheap labor. But they will be like winners in a poker game on the Titanic. The wounds inflicted on their nation will be too deep to be acceptable without brutal consequences.

Of course, there will be those who will benefit from these extraordinary changes -- principally, companies with access to an almost inexhaustible supply of very cheap labor. But they will be like winners in a poker game on the Titanic. The wounds inflicted on their nation will be too deep to be acceptable without brutal consequences.

Until wage levels and standards of living in the developing world can be brought into closer alignment with those of the West, we must replace the concept of global trade by free and vigorously competitive regional markets. NAFTA and Europe are the two largest free trade areas ever created. Obviously both are more than big enough to insure highly competitive internal markets. they would not cut themselves off from the world, but would welcome innovation from anywhere. Foreign corporations wishing to sell their products would build factories in America, employ Americans and bring with them their technology and capital. The same , of course, is true for the European economy. What is more, each region would be free to decide how it wishes to trade with other regions including developing countries, entering into bilateral agreements to the mutual advantage of each party.