Chapter Four

The Purpose And Function Of Money

Any macro economic study that's conducted within the parameters of Raw Materials Economics requires a clear understanding of money. Most of us view money incorrectly. We go to work each day, and at the end of a pre-determined pay period, we receive a check for our efforts, and we assume the money earned is the real value received. We pay the rent or the mortgage, the car loan, the dentist, and the grocery store. This personal view of money causes our personal view of economics to be shortsighted and incomplete.

Any macro economic study that's conducted within the parameters of Raw Materials Economics requires a clear understanding of money. Most of us view money incorrectly. We go to work each day, and at the end of a pre-determined pay period, we receive a check for our efforts, and we assume the money earned is the real value received. We pay the rent or the mortgage, the car loan, the dentist, and the grocery store. This personal view of money causes our personal view of economics to be shortsighted and incomplete.

From a personal viewpoint, the whole question of money, wealth, and the economy appears to be confined within the transfer of currency from the employer to the employee, or to various people paid for goods and services. However, the movement of money reflects the movement of tangible wealth, and the movement of tangible wealth reflects the movement of energy from production to consumption. By following the money, and not the production and labor it represents, you miss the whole point of money.

From a personal viewpoint, the whole question of money, wealth, and the economy appears to be confined within the transfer of currency from the employer to the employee, or to various people paid for goods and services. However, the movement of money reflects the movement of tangible wealth, and the movement of tangible wealth reflects the movement of energy from production to consumption. By following the money, and not the production and labor it represents, you miss the whole point of money.

Money is a convenient system to exchange or store wealth. People do very nicely without money in a simple economy by trading through a barter system. A farmer might need a new hoe blade, while the town's blacksmith might need a chicken for dinner. If the farmer and blacksmith are aware of their mutual needs, they can negotiate an exchange of a chicken for the hoe blade, so the farmer acquires a needed tool, and the blacksmith acquires a needed dinner. This works okay as long as exchanges remain simple. In a modern economy, we exchange so many goods and services that barter is altogether too cumbersome. So, we use money. Money enables the exchange of goods and services to run smoothly, but money isn't wealth. The production and the labor is the real wealth of the economy. The study of production, labor and real wealth is the universe of Raw Materials Economics.

Money is a convenient system to exchange or store wealth. People do very nicely without money in a simple economy by trading through a barter system. A farmer might need a new hoe blade, while the town's blacksmith might need a chicken for dinner. If the farmer and blacksmith are aware of their mutual needs, they can negotiate an exchange of a chicken for the hoe blade, so the farmer acquires a needed tool, and the blacksmith acquires a needed dinner. This works okay as long as exchanges remain simple. In a modern economy, we exchange so many goods and services that barter is altogether too cumbersome. So, we use money. Money enables the exchange of goods and services to run smoothly, but money isn't wealth. The production and the labor is the real wealth of the economy. The study of production, labor and real wealth is the universe of Raw Materials Economics.

Let's look to groceries for a good example of wealth. Groceries are a principal expenditure by all consumers. Every day we spend hard earned money for food. However, the money we spent was just a medium to exchange our labor for food; a way of simplifying the trade. You can't actually eat the money, and you can't logically find every market for your labor in terms of your immediate needs. You can eat the beef, corn, potatoes, and ice cream that you exchanged for the money you were paid for your labor. Money was needed, only because the grocer had no immediate need for your particular labors. So, paper money was established as a standard by which to exchange and warehouse goods, services, and labor. As a result, beef, vegetables and ice cream can be purchased with the money that represents labor. The production and the labor are wealth, the money only facilitates the exchange and movement of wealth.

Let's look to groceries for a good example of wealth. Groceries are a principal expenditure by all consumers. Every day we spend hard earned money for food. However, the money we spent was just a medium to exchange our labor for food; a way of simplifying the trade. You can't actually eat the money, and you can't logically find every market for your labor in terms of your immediate needs. You can eat the beef, corn, potatoes, and ice cream that you exchanged for the money you were paid for your labor. Money was needed, only because the grocer had no immediate need for your particular labors. So, paper money was established as a standard by which to exchange and warehouse goods, services, and labor. As a result, beef, vegetables and ice cream can be purchased with the money that represents labor. The production and the labor are wealth, the money only facilitates the exchange and movement of wealth.

Wealth can always be exchanged in a simple barter system if each party is aware of the other's needs. When money is used, the value of this wealth is measured in terms of money. Therefore tangible wealth, not money, is the basis for the economy. The food, the timber, the oil, the minerals, and certainly the intelligent labor that translates these materials into usable finished products are all wealth.

Wealth can always be exchanged in a simple barter system if each party is aware of the other's needs. When money is used, the value of this wealth is measured in terms of money. Therefore tangible wealth, not money, is the basis for the economy. The food, the timber, the oil, the minerals, and certainly the intelligent labor that translates these materials into usable finished products are all wealth.

If no new wealth were produced each year, the economy would stop, regardless of the amount of money in circulation. There would be nothing to finance; nothing to manufacture; and nothing to transport. In fact, without a constant flow of new wealth, there would be no organized society.

If no new wealth were produced each year, the economy would stop, regardless of the amount of money in circulation. There would be nothing to finance; nothing to manufacture; and nothing to transport. In fact, without a constant flow of new wealth, there would be no organized society.

It's easy to lose sight of this fact. Since a government can print money and assign the control of money to a central bank with seemingly unlimited power, it's fashionable to ignore the importance of new wealth, and focus on the paper money which appears to be the center of power and wealth

It's easy to lose sight of this fact. Since a government can print money and assign the control of money to a central bank with seemingly unlimited power, it's fashionable to ignore the importance of new wealth, and focus on the paper money which appears to be the center of power and wealth

CREATING MONEY

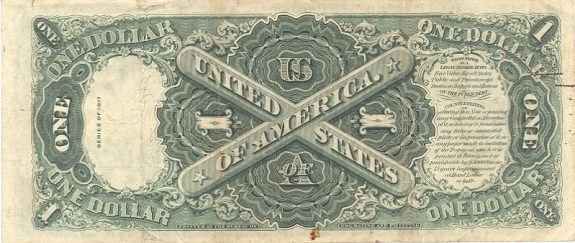

Any organized society can choose between a wide variety of monetary systems. These systems bring money into general circulation at a controlled volume, but can easily be exploited. The usual method of money creation is for a government to print a paper currency of specific denominations that display the effigy of some past national hero or ruler, along with the recognized logo of the country, and certain phrases and truisms familiar to the country. However, that is only the beginning of the story.

Any organized society can choose between a wide variety of monetary systems. These systems bring money into general circulation at a controlled volume, but can easily be exploited. The usual method of money creation is for a government to print a paper currency of specific denominations that display the effigy of some past national hero or ruler, along with the recognized logo of the country, and certain phrases and truisms familiar to the country. However, that is only the beginning of the story.

GOLD STANDARD

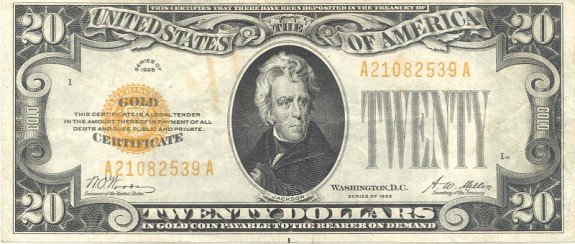

The gold standard is the most widely recognized monetary system. If paper money is printed in specifically regulated denominations to reflect the amount of gold (specie) held by institutions or citizens, the paper money can be called gold certificates. This monetary system is referred to as "the gold standard."

The gold standard is the most widely recognized monetary system. If paper money is printed in specifically regulated denominations to reflect the amount of gold (specie) held by institutions or citizens, the paper money can be called gold certificates. This monetary system is referred to as "the gold standard."

The gold standard limits the amount of currency in supply to the amount of gold in supply at a specific par value, and if additional paper is printed without mining and warehousing an additional amount of gold, the paper currency will not be redeemable in gold at its previous value. This causes the price of gold to increase in an effort to compensate for the additional volume of paper currency, or to compensate for the public's lack of faith in the exchangeability of the paper for gold.

The gold standard can be deflationary, since gold can be shipped to or from any country without regard to the impact on the general population. In effect, the gold standard can create a boom or bust overnight. Christopher Columbus remarked,

"Gold is a wonderful thing! Whoever possesses it is master of everything he desires. With gold, one can even get souls into heaven!" Columbus could have said the same for silver.

NATIONAL DEBT FREE MONEY

It is also acceptable for governments to print and issue various forms of paper money backed only by the government's own good faith and credit. Some governments print currency only to facilitate production and distribution. Others print money to fund domestic and foreign grants, to pay private companies for products and services, to pay the wages and salaries of government employees, or to fund military operations. This is a simple and direct method to expand a nation's money supply.

It is also acceptable for governments to print and issue various forms of paper money backed only by the government's own good faith and credit. Some governments print currency only to facilitate production and distribution. Others print money to fund domestic and foreign grants, to pay private companies for products and services, to pay the wages and salaries of government employees, or to fund military operations. This is a simple and direct method to expand a nation's money supply.

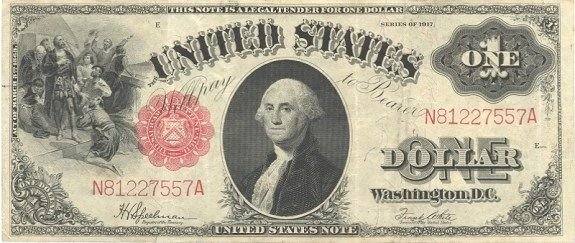

The U.S. government limits itself to a total of 300 Million Dollars of this type currency. This is less than one percent (1%) of our nation's total currency. In America, this national currency is called "United States Notes." This money is non interest bearing at the point of its creation and its value can be controlled by law. Its volume in circulation can legitimately be increased relative to the increases in the annual production and distribution of goods and services.

The U.S. government limits itself to a total of 300 Million Dollars of this type currency. This is less than one percent (1%) of our nation's total currency. In America, this national currency is called "United States Notes." This money is non interest bearing at the point of its creation and its value can be controlled by law. Its volume in circulation can legitimately be increased relative to the increases in the annual production and distribution of goods and services.

Excessive increases in this form of national money can be corrected through increased taxation. In other words, if the government prints too much money, the excess money can be taxed out of circulation.

Excessive increases in this form of national money can be corrected through increased taxation. In other words, if the government prints too much money, the excess money can be taxed out of circulation.

During the American Civil War, President Lincoln issued these Notes in large quantities and they became known as "greenbacks." During the depression, President Roosevelt issued 150 Million Dollars in United States Notes to stimulate the economy. President Kennedy also issued U. S.Notes, as did Lyndon Johnson and Richard Nixon.

During the American Civil War, President Lincoln issued these Notes in large quantities and they became known as "greenbacks." During the depression, President Roosevelt issued 150 Million Dollars in United States Notes to stimulate the economy. President Kennedy also issued U. S.Notes, as did Lyndon Johnson and Richard Nixon.

Creating debt free money (United States Notes) to facilitate the production and distribution of goods and services is most interesting. It might sound unique but as stated earlier, it is not a new idea. To understand the history of "creating debt free money", the Treasury Department's Bureau of Engraving and Printing was asked to outline the process. Here is their response:

"United States Notes, originally issued in 1862, were the first National currency. Federal Reserve Notes were not issued until the creation of the Federal Reserve System in 1913. Both types of currency were redeemable for gold until 1933, when the United States abandoned the gold standard. Since then, both currencies have served essentially the same purpose and have had the same value. The difference between them is a legal issue relating to the technical accounting of the note and who (the United States Treasury or the Federal Reserve System) has liability for each type of note.

The Federal Reserve System has the responsibility for maintaining growth and elasticity in the Unites States money supply based on economic conditions, and it uses Federal Reserve Notes for the active currency part of the money supply. Currently (April 1994), 99.7 percent (or about $413 billion) of all Unites States currency in circulation is Federal Reserve Notes. The Federal Reserve System "backs" this liability at its face value primarily with open market purchases of United States Treasury securities. The interest earned on these securities is deposited back in the Unites States Treasury along with all other Federal Reserve System revenues which exceed its operating costs.

United States Notes are "backed" by financial assets of the United States Government, including its ability to collect revenues. Therefore, it can be said that both Federal Reserve Notes and United States Notes are backed by the full faith and credit of the United States Government.

Presently, the issuance of Unites States Notes is subject to limitations established by Congress. Title 31 of the United States Code, Section 511(b), which was approved

September 19, 1982, established a statutory limitation of $300 million on the amount of Unites States Notes authorized to be outstanding and in circulation. The number of outstanding Unites States Notes is already at the statutory limit. Therefore, no new Unites States Notes can be issued by the Department of the Treasury. The last Unites States Notes were put into circulation in 1971."

DOLLAR BILLS

A private credit system can be used as an alternative to national money if it's accepted by the general population, as is the case with most of the money in America. American monetary policy is controlled by a privately owned central bank that acts as an independent agent for the U.S. Treasury. It is called the Federal Reserve System. "The Fed" creates money when it buys U.S. government debt, and when its member banks engage in fractional lending.

A private credit system can be used as an alternative to national money if it's accepted by the general population, as is the case with most of the money in America. American monetary policy is controlled by a privately owned central bank that acts as an independent agent for the U.S. Treasury. It is called the Federal Reserve System. "The Fed" creates money when it buys U.S. government debt, and when its member banks engage in fractional lending.

In the first example, the money supply, or the nation's credit is expanded when the Fed buys a long term interest bearing security (a form of debt) from the U.S. Treasury and pays for that security at no cost to itself by ordering Federal Reserve Notes from the Treasury Department's Bureau of Engraving and Printing, or by adding a credit (electronic entry) to the Treasury Department checking account without reducing its own account balance. At this point, the federal government begins to pay interest on this debt. It pays interest and eventually repays the principal indebtedness from its checking accounts that are funded either through taxation, by borrowing from national trust funds such as the Social Security Trust Fund, or by borrowing from foreign governments, the Federal Reserve itself, and from other sources. The Fed system also allows local banks to access new credit through several channels. The Fed can make new credit available from local banks by adding to the local bank's money reserve which means the local bank will instantly have more money to loan. Or, the local bank can borrow from the Federal Reserve regional bank for short periods of time, which is called "going to the window of the Fed."

The primary method for banks to expand the money supply is through the repeated loaning and re-loaning of their deposits or the re-lending of deposits they received from loan proceeds that originated at another bank. This repeated lending of the same funds occurs through a system called "fractional banking" or "fractional lending." This system creates local credit from the collateral of the property mortgaged during each loan transaction. This system can continue, as long as collateral is available to be mortgaged, and the money supply is inflated at a sufficient rate to pay the increasing cost of interest necessary for each successive transaction.

The primary method for banks to expand the money supply is through the repeated loaning and re-loaning of their deposits or the re-lending of deposits they received from loan proceeds that originated at another bank. This repeated lending of the same funds occurs through a system called "fractional banking" or "fractional lending." This system creates local credit from the collateral of the property mortgaged during each loan transaction. This system can continue, as long as collateral is available to be mortgaged, and the money supply is inflated at a sufficient rate to pay the increasing cost of interest necessary for each successive transaction.

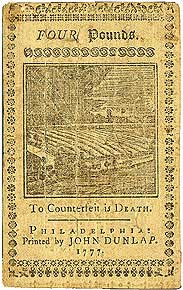

ILLEGAL COUNTERFEITING

Another system of currency creation is illegal counterfeiting. Counterfeiting causes dollars to be placed into existence and circulated by individuals so they can steal goods and services. Obviously, all governments attempt to eliminate this system because with too much counterfeiting, a government loses control of its money system regardless of monetary structure.

Another system of currency creation is illegal counterfeiting. Counterfeiting causes dollars to be placed into existence and circulated by individuals so they can steal goods and services. Obviously, all governments attempt to eliminate this system because with too much counterfeiting, a government loses control of its money system regardless of monetary structure.

PICK A SYSTEM

Any of these three legal money systems, the gold standard, the creation of interest free national notes, and the present system of borrowing to create credit, all place a form of money into circulation to represent products and services.

Any of these three legal money systems, the gold standard, the creation of interest free national notes, and the present system of borrowing to create credit, all place a form of money into circulation to represent products and services.

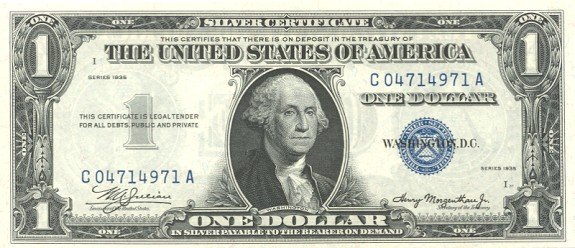

All these monetary systems create a usable exchange media. In the first example, citizens leave their gold or silver in bank vaults, and allow it to be represented by circulating certificates that reflect the lawful value of the stored precious metals. As more gold and silver is mined and brought into the society, more certificates can be exchanged.

All these monetary systems create a usable exchange media. In the first example, citizens leave their gold or silver in bank vaults, and allow it to be represented by circulating certificates that reflect the lawful value of the stored precious metals. As more gold and silver is mined and brought into the society, more certificates can be exchanged.

In the second example, government notes are created at a small expense to the taxpayers by the central treasury. This money is issued to public authorities such as county or state governments, or to local banks. It can also be spent into retail circulation by the federal government. These "Unites States Notes" are always legal tender whether loaned into circulation by local banks, or spent into circulation outside the banking system by government. The amount of these notes in circulation can easily be monitored.

In the second example, government notes are created at a small expense to the taxpayers by the central treasury. This money is issued to public authorities such as county or state governments, or to local banks. It can also be spent into retail circulation by the federal government. These "Unites States Notes" are always legal tender whether loaned into circulation by local banks, or spent into circulation outside the banking system by government. The amount of these notes in circulation can easily be monitored.

In the third example, dollar bills that reflect a standardized credit system place interest bearing debt into existence to be used as money.

In the third example, dollar bills that reflect a standardized credit system place interest bearing debt into existence to be used as money.

CREATING LOCAL DEBT FREE MONEY

During the depression of the 1930's many businesses and even some municipalities created and circulated non interest bearing money as a means to exchange the labor of their idle work force. One of the best examples of this occurred in Minden, Nebraska and was organized by Congressman Binderup (pronounced Benderup) of the 3rd Congressional District of Western Nebraska.

During the depression of the 1930's many businesses and even some municipalities created and circulated non interest bearing money as a means to exchange the labor of their idle work force. One of the best examples of this occurred in Minden, Nebraska and was organized by Congressman Binderup (pronounced Benderup) of the 3rd Congressional District of Western Nebraska.

Here is the story of "Minden Industrial Money," and how the economic situation of one small community was improved during the depression by increasing the local money supply and how it was accomplished without creating inflation or any depreciation of the local money. It was an excellent example of a localized interest free monetary system.

Here is the story of "Minden Industrial Money," and how the economic situation of one small community was improved during the depression by increasing the local money supply and how it was accomplished without creating inflation or any depreciation of the local money. It was an excellent example of a localized interest free monetary system.

Here is the story, told by the Congressman:

"It was December 1932. Two experts in the chicken hatchery business came into my office and surprised me by showing me that there was a large amount of egg production in my county, and suggested, "You need a good up-to-date hatchery in your town and we have come to make you a proposition. If you will build us a hatchery building, according to our specifications, we will equip it with the latest and most modern equipment and give you a long term bonded lease."

"It was December 1932. Two experts in the chicken hatchery business came into my office and surprised me by showing me that there was a large amount of egg production in my county, and suggested, "You need a good up-to-date hatchery in your town and we have come to make you a proposition. If you will build us a hatchery building, according to our specifications, we will equip it with the latest and most modern equipment and give you a long term bonded lease."

December of 1932 was the climax of the money panic that started in 1929, and no one had money to invest. There was plenty of empty brick buildings in town, which loomed high as a monument to the depression, but there was no building suitable for a hatchery. I asked my hatchery people to come back in a couple of days and I promised them that I would think it over.

Realizing the great benefit it would be to the farmers of our county, as well as to our little city, I tried to raise the money, but no money to invest did I find.

Thirteen banks in the area had closed their doors - bankrupt - another thirteen dismal monuments to a depression that had robbed thousands of our people of their lifetime savings.

I remembered reading the history of the Guernsey Island Market House, and how the people of the small Island off the coast of England had created their own money to build a marketing center for their goods. Although I had tried the plan twice before, however not so successfully, I decided to try again, so I drew up an agreement which every area merchant, doctor, dentist, garage and filling station owner signed, all agreeing that they would accept our own money called "Minden Industrial Money" in exchange for services and merchandise. always at par. This was done to create employment, as well as to build a new hatchery, and by constructive planning we accomplished both. So, we started to build a brick building without a cent of Federal Reserve System money, and we finished the building without, at any time, borrowing a cent of bank credit. In fact we finished the project without paying a cent of interest whatever, with the understanding that as soon as the rent came in we would first retire our major indebtedness to the lumberyard for plate-glass, steel, face brick, and some new lumber.

We bought an old building, wrecked it and used the lumber, and, as the Minden Money was paid to labor, it circulated freely among the merchants, and everything worked 100%. Never in the history of the project was the Minden Money turned down, except for one store, which opposed us at first to the extent that the manager put a sign in the window which read, "We will not accept 'Minden Industrial Money'." But, when we got started and the merchant saw the amount of business he was losing, the sign in the window was changed to read, "We accept 'Minden Industrial Money'."

Thirty miles from our town was a brick yard that had failed, and it was there we got most of our brick. We hired labor to clean the brick and idle trucks and truck drivers to haul the brick to Minden. We paid good wages in the form of Minden Money to every worker and we employed mechanics and helpers in all the building trades.

I am frequently asked, "Why don't you build other buildings with Minden Industrial Money, since this effort was so successful?"

This very morning two local merchants called and asked me to build again, under the same plan, but this requires careful management, and to me life is too busy and time too short to try to create a measure of prosperity in just one community. No nation or people can be prosperous for any length of time by merely having a spot here and there that is prosperous.

A successful debt free money system must have national scope, backed by national authority and operated for the good of all people. It must provide by law that the same money can be used for all purposes within the nation, both public and private, and that if any individual refuses the money, the debt to that individual is immediately canceled.

As far as soundness is concerned, Minden Industrial Money was more sound than the Federal Reserve money we use every day. Our Minden money was based on a specific thing, a building that was being constructed with a bonded lease signed in advance, and with the promise to retire our Minden money from the rent that was collected. And, it was all done without interest! The Minden Money in circulation represented labor and tangible materials, and finally a new functional facility. The money carried no interest that could have debased its value or produced inflation."

Interestingly, Congressman Binderup's success was ultimately his downfall. He was defeated in the election of 1934 while the Minden Industrial Money was still in circulation. Some of the townspeople said they got tired of hearing him complain about monetary policy. Others were concerned that Minden Industrial Money was illegal.

Interestingly, Congressman Binderup's success was ultimately his downfall. He was defeated in the election of 1934 while the Minden Industrial Money was still in circulation. Some of the townspeople said they got tired of hearing him complain about monetary policy. Others were concerned that Minden Industrial Money was illegal.

BIG MONEY

One of the most cumbersome forms of money in circulation today can be found on the Yap Islands. Yap is comprised of 14 individual islands in the Caroline Island group about 1000 miles east of the Philippines and about 500 miles southwest of Guam.

One of the most cumbersome forms of money in circulation today can be found on the Yap Islands. Yap is comprised of 14 individual islands in the Caroline Island group about 1000 miles east of the Philippines and about 500 miles southwest of Guam.

For decades, the natives of Yap have used approximately 7000 calcite disks of various sizes as a medium of exchange. To prevent debasement of this unique specie, they have imported them from the neighboring Palau Islands. These disks are simply huge flat circular rocks with a hole in the center. Some are 10 feet high and weigh thousands of pounds. The largest denominations of this "money," stands upright and unguarded in front of homes and businesses.

For decades, the natives of Yap have used approximately 7000 calcite disks of various sizes as a medium of exchange. To prevent debasement of this unique specie, they have imported them from the neighboring Palau Islands. These disks are simply huge flat circular rocks with a hole in the center. Some are 10 feet high and weigh thousands of pounds. The largest denominations of this "money," stands upright and unguarded in front of homes and businesses.

As shown in this photo, Yap money needs no bank because to steal it would require a motorized crane and a tandem truck which would alert the entire neighborhood.

UNUSUAL MONEY

An award for monetary creativity should go to Olney, Texas for their rabbit tail money, and to Pismo Beach, California for their clamshell money.

An award for monetary creativity should go to Olney, Texas for their rabbit tail money, and to Pismo Beach, California for their clamshell money.

During the depression, rabbit tails were actually used as a medium of exchange in Olney, Texas. They were promoted by the local Chamber of Commerce. There were two motives behind the rabbit tail scheme. First, it became necessary to reduce the number of jack rabbits in the area, and second, was a need to promote trade in the area. Area merchants gave away shotgun shells to generate "rabbit tail drives." Each Monday, jack rabbits were harvested and their tails were used as payment for various services, and were exchanged for awards by area merchants.

During the depression, rabbit tails were actually used as a medium of exchange in Olney, Texas. They were promoted by the local Chamber of Commerce. There were two motives behind the rabbit tail scheme. First, it became necessary to reduce the number of jack rabbits in the area, and second, was a need to promote trade in the area. Area merchants gave away shotgun shells to generate "rabbit tail drives." Each Monday, jack rabbits were harvested and their tails were used as payment for various services, and were exchanged for awards by area merchants.

The jack rabbit population around Olney, Texas was reduced by 6000 due to this effort. The tails remained in circulation until after the bank holidays of 1933.

The jack rabbit population around Olney, Texas was reduced by 6000 due to this effort. The tails remained in circulation until after the bank holidays of 1933.

During that same time, clamshells were used in Pismo Beach, California as a medium of exchange. Again, the local Chamber of Commerce promoted and issued this strange scrip. Clamshells contained the following information:

During that same time, clamshells were used in Pismo Beach, California as a medium of exchange. Again, the local Chamber of Commerce promoted and issued this strange scrip. Clamshells contained the following information:

1. The issuer

1. The issuer

2. The date

2. The date

3. Denomination

3. Denomination

4. Official signature

4. Official signature

For all practical purposes, clamshells became money. They too, remained in circulation until after the bank holidays of 1933.

For all practical purposes, clamshells became money. They too, remained in circulation until after the bank holidays of 1933.

The history of greenbacks, Yap Island money and the story of depression era scrip, all demonstrate that money comes in many shapes and sizes, and many forms of money can be used as a medium to exchange and store wealth.

The history of greenbacks, Yap Island money and the story of depression era scrip, all demonstrate that money comes in many shapes and sizes, and many forms of money can be used as a medium to exchange and store wealth.

DEBT MONEY

Of all moneys, the Federal Reserve Note is the most complicated and the most difficult to understand. The Dollar "Bill" is a "bill of and for credit." It is a debt certificate that is used as money. Some people refer to Federal Reserve Notes as "monetized debt." They are standardized bills of exchange, or debts with no due date that are created for the purpose of exchanging wealth, but can't be exchanged for wealth by the regional Federal Reserve Bank that issued them. If this explanation sounds confusing, you might consider the following analogy:

Of all moneys, the Federal Reserve Note is the most complicated and the most difficult to understand. The Dollar "Bill" is a "bill of and for credit." It is a debt certificate that is used as money. Some people refer to Federal Reserve Notes as "monetized debt." They are standardized bills of exchange, or debts with no due date that are created for the purpose of exchanging wealth, but can't be exchanged for wealth by the regional Federal Reserve Bank that issued them. If this explanation sounds confusing, you might consider the following analogy:

Gather up all the unpaid bills or notices that prove you owe the electric company, the phone company, or the rent or mortgage on your home. Then, gather up all the accounts receivable or invoices that prove others owe you. Take them to the supermarket to buy groceries. Pick out your needed grocery items and go to the check out counter and present these bills for payment.

Gather up all the unpaid bills or notices that prove you owe the electric company, the phone company, or the rent or mortgage on your home. Then, gather up all the accounts receivable or invoices that prove others owe you. Take them to the supermarket to buy groceries. Pick out your needed grocery items and go to the check out counter and present these bills for payment.

This sounds ridiculous, but a Federal Reserve Note is simply the standardized green and stately reflection of societal income and debt that was converted into a form that could facilitate the exchange and consumption of goods and services.

This sounds ridiculous, but a Federal Reserve Note is simply the standardized green and stately reflection of societal income and debt that was converted into a form that could facilitate the exchange and consumption of goods and services.

On a personal basis, every debt you owe is someone else's receivable, and every receivable you hold is someone else's debt. Therefore, Federal Reserve Notes are standardized bills. So, if an adequate amount of dollar bills are circulated, all individual bills between people can be exchanged for the standardized measure of money called dollar bills. If too few of these standardized dollar bills exist, more electronic or check money must take their place, or unpaid personal bills plus more borrowing and abstinence from production and consumption must fill in the gap.

On a personal basis, every debt you owe is someone else's receivable, and every receivable you hold is someone else's debt. Therefore, Federal Reserve Notes are standardized bills. So, if an adequate amount of dollar bills are circulated, all individual bills between people can be exchanged for the standardized measure of money called dollar bills. If too few of these standardized dollar bills exist, more electronic or check money must take their place, or unpaid personal bills plus more borrowing and abstinence from production and consumption must fill in the gap.

Twelve different dollar bills of each denomination are currently printed. They have discrete differences depending upon the regional Reserve Bank that issued them. The difference is the round seal, denoting the issuing bank, that is affixed to the left of George Washington's face, or Abe Lincoln's face, etc. If a dollar bill is ordered from the Bureau of Engraving and Printing by the Atlanta Bank, it will carry the letter "F" on its seal. For New York, the letter is "B," for Richmond Virginia it's "E" and so forth. Orders for these bills are made by the regional banks through the Federal Reserve's Board of Governors in Washington, DC. Each order is transferred to the Comptroller of Currency who passes them to the Bureau of Engraving and Printing. Originally, Federal Reserve Notes were redeemable in Gold and carried the gold colored endorsement. This redeemability was removed by the Gold Reserve Act of January 30, 1934. Subsequent Federal Reserve Notes were considered legal tender.

Twelve different dollar bills of each denomination are currently printed. They have discrete differences depending upon the regional Reserve Bank that issued them. The difference is the round seal, denoting the issuing bank, that is affixed to the left of George Washington's face, or Abe Lincoln's face, etc. If a dollar bill is ordered from the Bureau of Engraving and Printing by the Atlanta Bank, it will carry the letter "F" on its seal. For New York, the letter is "B," for Richmond Virginia it's "E" and so forth. Orders for these bills are made by the regional banks through the Federal Reserve's Board of Governors in Washington, DC. Each order is transferred to the Comptroller of Currency who passes them to the Bureau of Engraving and Printing. Originally, Federal Reserve Notes were redeemable in Gold and carried the gold colored endorsement. This redeemability was removed by the Gold Reserve Act of January 30, 1934. Subsequent Federal Reserve Notes were considered legal tender.

The future of United States paper money may be found on a "smart card." Smart cards are credit-card-like instruments on which monetary value is placed. They are a substitute for paper money and are capable of storing personal credit information on small microchips. Currently, smart cards are being tested throughout the United States.

The future of United States paper money may be found on a "smart card." Smart cards are credit-card-like instruments on which monetary value is placed. They are a substitute for paper money and are capable of storing personal credit information on small microchips. Currently, smart cards are being tested throughout the United States.

Treasury Department officials explain that 60% to 70% of all U.S. currency is held outside the United States. Therefore, less than 150 Billion Dollars in currency is available for circulation within the U.S.

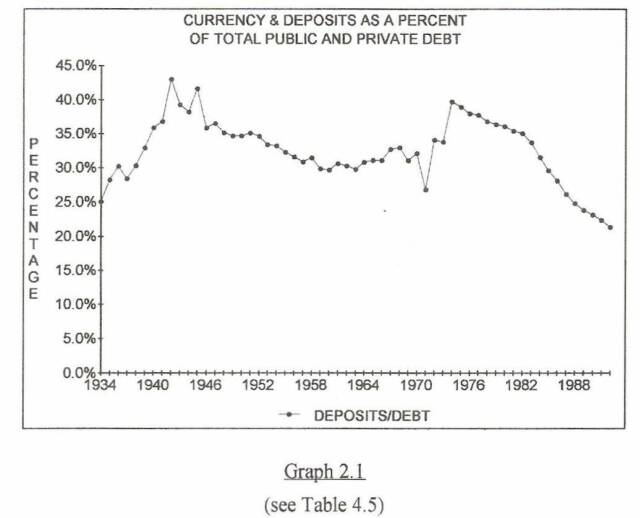

This Graph points out that too few of these "bills" exist. If all deposits and currency were suddenly applied to America's gross public and private debt, the normal flow of funds would be shifted into reverse and initially satisfy only 21.2% of the debt. The system functions because people continue to borrow and spend with little caution. This maintains the speed or velocity of the flow of funds.

Under the current system, as new debt is created, both by government and the private sector, old debt gets partially recapitalized as inflated value but it can't be repaid because paying off the old debt slows down the flow of funds. A classic example of this phenomenon is the public debt. There is always a clamor from those who least understand money and banking to pay off the public debt. This is an absurd notion in an economy driven by the fractional lending of checkable deposits. As of this update, 2012, the federal government "owes" 16 trillion dollars to its citizens, the Federal Reserve and other countries. For purposes of this exercise, lets try to pay off 1/3 of this amount through taxation over 10 years. This adds 500 billion dollars annually to our federal tax burden.

Here is the catch 22. When the government collects the money, it will simply apply the money to the existing year's deficit as the money arrives. Worse, any amount repaid to the Federal Reserve System will instantly evaporate out of existence. Thus, the exercise will reduce the money supply by the 500 billion dollars plus the number of times the money would have exchanged hands within the private sector, had it remained in circulation. This trap was set by big banks over 100 years ago and it demands perpetual borrowing or the system collapses. Sadly, few leaders in government and almost no one in the private sector, (except the major bankers) really understand it.

EARLY ATTEMPTS AT MONETARY REFORM

One early debate on monetary policy surrounded the First Bank of the United Stat

One early debate on monetary policy surrounded the First Bank of the United Stat

es. It was established in 1791, and operated under the leadership of Treasury Secretary Alexander Hamilton. It was America's first "National Bank", and it met strong opposition from Jefferson and Madison.

Debates over monetary systems have always been volatile. The most divisive of these debates occurred when President Andrew Jackson eliminated the Second Bank of the United States in 1832, and thus set the stage for subsequent monetary contests.

Debates over monetary systems have always been volatile. The most divisive of these debates occurred when President Andrew Jackson eliminated the Second Bank of the United States in 1832, and thus set the stage for subsequent monetary contests.

The Second Bank of the United States was chartered in 1816 for a 20 year period to maintain authority over the US monetary system. Like most of his predecessors, Jackson disliked the bank for its lack of desire to establish a "sound and uniform" money; which had been its primary chartered obligation.

The Second Bank of the United States was chartered in 1816 for a 20 year period to maintain authority over the US monetary system. Like most of his predecessors, Jackson disliked the bank for its lack of desire to establish a "sound and uniform" money; which had been its primary chartered obligation.

In 1832, Congress passed a law that extended the banks charter, and President Jackson promptly vetoed the law! Nicholas Biddle, the bank's president, called Jackson's veto a "manifesto of anarchy" but Congress upheld the veto and the (bank wars) began. The Democratic Republicans, the political party that supported Jackson in the first election, soon split. The pro bank forces called themselves "National Republicans" and nominated Henry Clay for president. The pro Jackson wing of the old Jefferson Democratic Republican Party became the "Democratic Party" and nominated Jackson, who won re-election in the fall of 1832.

In 1832, Congress passed a law that extended the banks charter, and President Jackson promptly vetoed the law! Nicholas Biddle, the bank's president, called Jackson's veto a "manifesto of anarchy" but Congress upheld the veto and the (bank wars) began. The Democratic Republicans, the political party that supported Jackson in the first election, soon split. The pro bank forces called themselves "National Republicans" and nominated Henry Clay for president. The pro Jackson wing of the old Jefferson Democratic Republican Party became the "Democratic Party" and nominated Jackson, who won re-election in the fall of 1832.

Jackson had originally appointed Louis McLane as Secretary of the Treasury and ordered McLane to remove all public money from the Second National Bank, but McLane refused, so Jackson fired him and appointed William J. Duane as Secretary, but Duane also refused Jackson's order. Then, after his re-election, Jackson appointed Roger Taney as Treasury Secretary and Taney quickly began to follow Jackson's orders. Even before Taney's Senate confirmation, he removed all government funds from the Second National Bank and deposited them in state banks. Under pressure from Biddle and his political machine, Congress retaliated against Taney by rejecting his nomination as Secretary of the Treasury. This was the first time in U.S. history that a presidential nomination was rejected by the Senate. However, with the federal money removed from the Second Bank of the United States, it was finally reduced to the Bank of the United States of Pennsylvania.

Jackson had originally appointed Louis McLane as Secretary of the Treasury and ordered McLane to remove all public money from the Second National Bank, but McLane refused, so Jackson fired him and appointed William J. Duane as Secretary, but Duane also refused Jackson's order. Then, after his re-election, Jackson appointed Roger Taney as Treasury Secretary and Taney quickly began to follow Jackson's orders. Even before Taney's Senate confirmation, he removed all government funds from the Second National Bank and deposited them in state banks. Under pressure from Biddle and his political machine, Congress retaliated against Taney by rejecting his nomination as Secretary of the Treasury. This was the first time in U.S. history that a presidential nomination was rejected by the Senate. However, with the federal money removed from the Second Bank of the United States, it was finally reduced to the Bank of the United States of Pennsylvania.

Throughout the Jackson-Biddle bank wars, Jackson's detractors referred to him as that "Jackass Jackson." Some newspaper cartoonists drew pictures of him riding the government "pig." Others depicted Jackson as a donkey that was either kicking the working poor or pulling against the powerful banking interests. After his retirement, Jackson was depicted as an old man pulling a balking jackass. The modern Republican party split from the Democrats over slavery and depicted the Democrats as stubborn jackasses. By the 1874 election, Thomas Nast, a famous cartoonist for Harpers Weekly, finally popularized both the donkey and elephant. These mascots evolved from demeaning caricatures to the symbols of our major political parties.

Throughout the Jackson-Biddle bank wars, Jackson's detractors referred to him as that "Jackass Jackson." Some newspaper cartoonists drew pictures of him riding the government "pig." Others depicted Jackson as a donkey that was either kicking the working poor or pulling against the powerful banking interests. After his retirement, Jackson was depicted as an old man pulling a balking jackass. The modern Republican party split from the Democrats over slavery and depicted the Democrats as stubborn jackasses. By the 1874 election, Thomas Nast, a famous cartoonist for Harpers Weekly, finally popularized both the donkey and elephant. These mascots evolved from demeaning caricatures to the symbols of our major political parties.

THE BIRTH OF THE FEDERAL RESERVE SYSTEM

William Jennings Bryan was the Democratic Party standard bearer for two decades around the beginning of the 20th century. Bryan sought to establish policies that would eliminate the boom and bust cycles of the gold standard when he campaigned for President on a platform of monetary reform. These boom and bust cycles had become a chronic problem of the gold standard monetary system which had caused a short, but serious depression in 1907.

William Jennings Bryan was the Democratic Party standard bearer for two decades around the beginning of the 20th century. Bryan sought to establish policies that would eliminate the boom and bust cycles of the gold standard when he campaigned for President on a platform of monetary reform. These boom and bust cycles had become a chronic problem of the gold standard monetary system which had caused a short, but serious depression in 1907.

Bryan worked with House Democrats like Carter Glass, Chairman of the House Banking Committee and Sen. Robert Latham Owen to craft a people friendly Fed. They campaigned for a version of the Federal Reserve Act which was considered too people friendly for the great banking houses. The bill called for directors of the Federal Reserve Banks to "be representative of the general public interest of the reserve district."

Bryan worked with House Democrats like Carter Glass, Chairman of the House Banking Committee and Sen. Robert Latham Owen to craft a people friendly Fed. They campaigned for a version of the Federal Reserve Act which was considered too people friendly for the great banking houses. The bill called for directors of the Federal Reserve Banks to "be representative of the general public interest of the reserve district."

The original Senate version of the bill was the "banker bill" and was promoted by Sen. Nelson Aldrich of Rhode Island, chairman of the Senate Finance Committee, who left the Senate during the multi-year debate to head of the National Monetary Commission and to work full time on the issue. He was joined by Paul Moritz Warburg, a German immigrant who moved to America in 1903. In Germany, Paul Warburg had been employed by the family business, called the M.M.Warburg Company which represented the Rothchild fund. It was the same fund that later financed the Kaiser in World War I against America.

The original Senate version of the bill was the "banker bill" and was promoted by Sen. Nelson Aldrich of Rhode Island, chairman of the Senate Finance Committee, who left the Senate during the multi-year debate to head of the National Monetary Commission and to work full time on the issue. He was joined by Paul Moritz Warburg, a German immigrant who moved to America in 1903. In Germany, Paul Warburg had been employed by the family business, called the M.M.Warburg Company which represented the Rothchild fund. It was the same fund that later financed the Kaiser in World War I against America.

After many visited to America, Warburg finally moved to New York where he married Nina Loeb. He was eventually installed as a partner in the Loeb banking house of Kuhn, Loeb & Company. His primary interest remained banker controlled monetary reform. In essence, the debate over monetary policy developed as a contest for power between populists like Bryan and the great banking houses of the day.

After many visited to America, Warburg finally moved to New York where he married Nina Loeb. He was eventually installed as a partner in the Loeb banking house of Kuhn, Loeb & Company. His primary interest remained banker controlled monetary reform. In essence, the debate over monetary policy developed as a contest for power between populists like Bryan and the great banking houses of the day.

During the debate on the Federal Reserve Act, both sides removed and replaced certain passages in the proposed legislation that reflected a contest for control of the monetary system. For instance, the language about appointments to the new Federal Reserve Board stated that Federal Reserve Board members must reflect "the general public interest." This language was first replaced by the House of Representatives to read, "be actively engaged in their district in commerce, in agriculture or in some other industrial pursuit." However, the final version as passed, contained the Senate language. It was influenced by the Warburg lobby and said something completely different. It stated that Federal Reserve Board members "must be persons of tested banking experience."

During the debate on the Federal Reserve Act, both sides removed and replaced certain passages in the proposed legislation that reflected a contest for control of the monetary system. For instance, the language about appointments to the new Federal Reserve Board stated that Federal Reserve Board members must reflect "the general public interest." This language was first replaced by the House of Representatives to read, "be actively engaged in their district in commerce, in agriculture or in some other industrial pursuit." However, the final version as passed, contained the Senate language. It was influenced by the Warburg lobby and said something completely different. It stated that Federal Reserve Board members "must be persons of tested banking experience."

Also, the House version of the bill stated that "to suspend the officials of the Federal Reserve System Banks for cause, the complaint must be stated in writing with opportunity for hearing before the removal of said officials for incompetence, dereliction of duty, fraud, or deceit, such removal to be subject to approval of the President of the United States." In the Senate, the language was changed to read, "to suspend or remove any official or director of any Federal Reserve Bank, the cause of such removal should be brought forth in writing by the Federal Reserve Board to the removed official." This language gave the Federal Reserve its independence from government control.

Also, the House version of the bill stated that "to suspend the officials of the Federal Reserve System Banks for cause, the complaint must be stated in writing with opportunity for hearing before the removal of said officials for incompetence, dereliction of duty, fraud, or deceit, such removal to be subject to approval of the President of the United States." In the Senate, the language was changed to read, "to suspend or remove any official or director of any Federal Reserve Bank, the cause of such removal should be brought forth in writing by the Federal Reserve Board to the removed official." This language gave the Federal Reserve its independence from government control.

Before the Aldrich Plan could be enacted into law, the Democrats won the White House and took control of the Congress in 1912. The Democratic position called for a divisional reserve bank system, with a number of reserve banks or central banking cities. Nevertheless, President Woodrow Wilson believed that the Aldrich Plan was "60-70 percent correct." As a result, the plan became the basis for constructing the Federal Reserve bill, which began to take shape in Congress with the presentation of a bill proposed by Sen. Robert Latham Owen in May 1913.

Before the Aldrich Plan could be enacted into law, the Democrats won the White House and took control of the Congress in 1912. The Democratic position called for a divisional reserve bank system, with a number of reserve banks or central banking cities. Nevertheless, President Woodrow Wilson believed that the Aldrich Plan was "60-70 percent correct." As a result, the plan became the basis for constructing the Federal Reserve bill, which began to take shape in Congress with the presentation of a bill proposed by Sen. Robert Latham Owen in May 1913.

Shortly after the passage of the bill, President Wilson appointed Paul Warburg to the Federal Reserve Board. This occurred only two years after Warburg became an American citizen.

Shortly after the passage of the bill, President Wilson appointed Paul Warburg to the Federal Reserve Board. This occurred only two years after Warburg became an American citizen.

The bank wars were not over. The new Fed acted to cancel the charters of both the Kansas City and Dallas Regional Federal Reserve Banks in an attempt to consolidate control of money and credit in New York. This action resulted in a court battle that lasted more than a decade. The Supreme Court eventually restored these charters which permanently diluted some of the lopsided control of the New York banks. Even today, the Federal Reserve System gives undemocratic authority to the New York bank by allowing it a permanent chair on the Open Market Committee that sets interest rates. Other eastern regional Federal Reserve banks are rotated every other year, while the Midwest, south, and west coast banks are given only a one in three year voting rotation.

The bank wars were not over. The new Fed acted to cancel the charters of both the Kansas City and Dallas Regional Federal Reserve Banks in an attempt to consolidate control of money and credit in New York. This action resulted in a court battle that lasted more than a decade. The Supreme Court eventually restored these charters which permanently diluted some of the lopsided control of the New York banks. Even today, the Federal Reserve System gives undemocratic authority to the New York bank by allowing it a permanent chair on the Open Market Committee that sets interest rates. Other eastern regional Federal Reserve banks are rotated every other year, while the Midwest, south, and west coast banks are given only a one in three year voting rotation.

Although the final Glass-Owen Federal Reserve bill retained some progressive initiatives, Bryan lamented his efforts with the following quote:

Although the final Glass-Owen Federal Reserve bill retained some progressive initiatives, Bryan lamented his efforts with the following quote:

"In my long political career, the one thing I genuinely regret is my part in getting the banking and currency legislation enacted into law."

These stories illustrate the extreme difficulty of making fair changes to the monetary system.

These stories illustrate the extreme difficulty of making fair changes to the monetary system.

History demonstrates that current monetary policy, even though outdated, is superior to a Laissez faire gold standard that can produce a monetary crisis overnight if gold is moved offshore, thus drying up credit and breaking down commerce.

History demonstrates that current monetary policy, even though outdated, is superior to a Laissez faire gold standard that can produce a monetary crisis overnight if gold is moved offshore, thus drying up credit and breaking down commerce.

Consider again the words of William Jennings Bryan as he closed his acceptance speech at the 1896 Democratic National Convention in Chicago:

Consider again the words of William Jennings Bryan as he closed his acceptance speech at the 1896 Democratic National Convention in Chicago:

"You shall not press down upon the brow of labor this crown of thorns, you shall not crucify mankind upon a cross of gold."

Basically, Bryan was attacking the gold standard as being exploitive to the working class. As an alternative, Bryan and others proposed the free coinage of silver.

Basically, Bryan was attacking the gold standard as being exploitive to the working class. As an alternative, Bryan and others proposed the free coinage of silver.

Over one hundred years after Bryan's oration, a new message is appropriate, but it should be directed to the Congress of the United States, not at the Federal Reserve System or local banks. It might read:

Over one hundred years after Bryan's oration, a new message is appropriate, but it should be directed to the Congress of the United States, not at the Federal Reserve System or local banks. It might read:

You shall not press down upon the brow of labor this crown of thorns, you shall not sacrifice the American private enterprise system upon this altar of debt.

THE CAUSE AND EFFECT OF INTEREST

When the Fed raises interest rates, it places the same crown of thorns on all working Americans. During 1994, the Fed raised interest rates to offset "upward pressure on prices of a number of industrial materials". It ignored the natural forces at work within the economy; forces that attempted to monetize previously underpriced tangible wealth. The Fed appeared ignorant that higher prices for these "industrial materials" eventually help the economy regain natural internal balance and higher profitability.

When the Fed raises interest rates, it places the same crown of thorns on all working Americans. During 1994, the Fed raised interest rates to offset "upward pressure on prices of a number of industrial materials". It ignored the natural forces at work within the economy; forces that attempted to monetize previously underpriced tangible wealth. The Fed appeared ignorant that higher prices for these "industrial materials" eventually help the economy regain natural internal balance and higher profitability.

The rate hike simply converted more of the value of the wealth in the economic pipeline into unearned interest income. In essence, Fed induced higher interest rates captured and killed the new profits that should be earned from production, thus offsetting any positive impact produced by the economies' attempt at natural price correction. The higher short term rates over-tightened the money supply resulting in a 2% increase in long term mortgage rates. This translated to a $200.00 per month increase cost of the average new home and a dramatic drop in new housing starts.

The rate hike simply converted more of the value of the wealth in the economic pipeline into unearned interest income. In essence, Fed induced higher interest rates captured and killed the new profits that should be earned from production, thus offsetting any positive impact produced by the economies' attempt at natural price correction. The higher short term rates over-tightened the money supply resulting in a 2% increase in long term mortgage rates. This translated to a $200.00 per month increase cost of the average new home and a dramatic drop in new housing starts.

In March of 2000, the Fed initiated its most unforgivable series of mistakes since the 1970s when it began to systematically "nuke" the economy with repeated and unnecessary rate hikes designed to offset what Chairman Greenspan referred to as "illogical exuberance." After unnecessarily raising interest rates six times, the economy began to implode so, the Fed reversed course and dropped rates nine times.

In March of 2000, the Fed initiated its most unforgivable series of mistakes since the 1970s when it began to systematically "nuke" the economy with repeated and unnecessary rate hikes designed to offset what Chairman Greenspan referred to as "illogical exuberance." After unnecessarily raising interest rates six times, the economy began to implode so, the Fed reversed course and dropped rates nine times.

The Feds actions destroyed the so-called dot com "bubble" and along with it, thousands of Internet businesses which admittedly, were founded on questionable business models. However, in the process, they halted the flow of capital to hundreds of deserving new high tech businesses which were poised to add more efficiency to American commerce. Their actions produced a short but brutal recession which, at his writing, has been compounded by the attacks of 9-11 2001.

The Feds actions destroyed the so-called dot com "bubble" and along with it, thousands of Internet businesses which admittedly, were founded on questionable business models. However, in the process, they halted the flow of capital to hundreds of deserving new high tech businesses which were poised to add more efficiency to American commerce. Their actions produced a short but brutal recession which, at his writing, has been compounded by the attacks of 9-11 2001.

Generally speaking, when cash flow projections are made by any business, the cost of interest is always added to the expense side of the ledger. Even the Government views the net profit on interest as "net interest" cost, and displays the sum as a primary cost segment of National Income. Obviously, interest adds to the cost of doing business; a simple bit of logic that seems lost on the Fed.

Generally speaking, when cash flow projections are made by any business, the cost of interest is always added to the expense side of the ledger. Even the Government views the net profit on interest as "net interest" cost, and displays the sum as a primary cost segment of National Income. Obviously, interest adds to the cost of doing business; a simple bit of logic that seems lost on the Fed.

Higher interest rates add unnecessary pressure to the economic system by causing inflation and the redistribution of wealth. Perpetual inflation caused by interest is certainly subtle, but quite harmful because it adds to the cost of everything without adding to the intrinsic value of anything. Interest carves a tribute from every segment of the economy. This is a flaw in the private enterprise system produced by a flaw in the monetary system, however, the flaw can be minimized.

Higher interest rates add unnecessary pressure to the economic system by causing inflation and the redistribution of wealth. Perpetual inflation caused by interest is certainly subtle, but quite harmful because it adds to the cost of everything without adding to the intrinsic value of anything. Interest carves a tribute from every segment of the economy. This is a flaw in the private enterprise system produced by a flaw in the monetary system, however, the flaw can be minimized.

With the passage of the Federal Reserve Act, Congress gave the new "Fed" control of the money supply and the ability to raise or lower short term interest rates to modulate the flow of credit. This system keeps interest rates above the inflation rate so money doesn't lose "value." This system also prevents interest earnings on savings deposits from offsetting future inflated dollar value of the borrower's collateral held by the banks. The difference between the higher interest rate and the lower inflation rate is known as the "real interest" rate.

With the passage of the Federal Reserve Act, Congress gave the new "Fed" control of the money supply and the ability to raise or lower short term interest rates to modulate the flow of credit. This system keeps interest rates above the inflation rate so money doesn't lose "value." This system also prevents interest earnings on savings deposits from offsetting future inflated dollar value of the borrower's collateral held by the banks. The difference between the higher interest rate and the lower inflation rate is known as the "real interest" rate.

If interest rates fall below the inflation rate, Federal Reserve Notes will lose their value as a commodity. This allows entrepreneurs to repay loans with cheaper dollars, and reduce their overall debt at the expense of the banking system and savings depositors. So, the Fed will always attempt to keep interest rates above the inflation rate. This results in a subtle system of interest driven inflation.

If interest rates fall below the inflation rate, Federal Reserve Notes will lose their value as a commodity. This allows entrepreneurs to repay loans with cheaper dollars, and reduce their overall debt at the expense of the banking system and savings depositors. So, the Fed will always attempt to keep interest rates above the inflation rate. This results in a subtle system of interest driven inflation.

If the inflation rate is less than the interest rate during the term of loans, everything works perfectly for the lender because interest rates have been kept real, or above the inflation rate. Stated another way, during periods of low inflation, money maintains its commodity value in terms of alternative property investments. So, when interest rates are "real," or above inflation, it becomes advantageous to acquire money and sell property and loan the money to others. However, during a more inflationary period, prices can increase greatly after fixed loans are made at low interest rates. In these instances, inflation can cause property to increase in perceived value by 10% annually during the term of a loan which may demand 8% annual interest. This allows aggressive borrowers to purchase property with borrowed funds and use inflation to pay off the property when it is re-sold. In these instances, the banking system raises interest rates above the inflation rate to insure the net value of debt.

If the inflation rate is less than the interest rate during the term of loans, everything works perfectly for the lender because interest rates have been kept real, or above the inflation rate. Stated another way, during periods of low inflation, money maintains its commodity value in terms of alternative property investments. So, when interest rates are "real," or above inflation, it becomes advantageous to acquire money and sell property and loan the money to others. However, during a more inflationary period, prices can increase greatly after fixed loans are made at low interest rates. In these instances, inflation can cause property to increase in perceived value by 10% annually during the term of a loan which may demand 8% annual interest. This allows aggressive borrowers to purchase property with borrowed funds and use inflation to pay off the property when it is re-sold. In these instances, the banking system raises interest rates above the inflation rate to insure the net value of debt.

Those who borrowed production credit at 16%, 18% or 20% interest during the 1970's, are painfully aware that interest adds to inflation and lowers the amount of debt free money in circulation.

Those who borrowed production credit at 16%, 18% or 20% interest during the 1970's, are painfully aware that interest adds to inflation and lowers the amount of debt free money in circulation.

This flaw in the monetary system was multiplied throughout millions of transactions during the 1970's. It only stopped when high interest rates ground the economy to a halt. Consequently, the Reagan administration deemed it necessary to jump start the economy with a tax cut in the early 1980's and supported unprecedented levels of debt expansion during the mid-1980's.

This flaw in the monetary system was multiplied throughout millions of transactions during the 1970's. It only stopped when high interest rates ground the economy to a halt. Consequently, the Reagan administration deemed it necessary to jump start the economy with a tax cut in the early 1980's and supported unprecedented levels of debt expansion during the mid-1980's.

These convulsive events would not be necessary, if money maintained its value in terms of things. Instead, monetary policies cause money to maintain its value in terms of money. Raw Materials Economics establishes a stable money in terms of things, so the value of things are based on intrinsic value instead of perceived value.

These convulsive events would not be necessary, if money maintained its value in terms of things. Instead, monetary policies cause money to maintain its value in terms of money. Raw Materials Economics establishes a stable money in terms of things, so the value of things are based on intrinsic value instead of perceived value.

ALTERNATIVE WAYS TO CONTROL THE VALUE OF MONEY

Instead of holding interest rates above inflation rates, (which results in systemic inflation), the percentage of down payments required for installment purchases should be increased during periods of inflation. This will route new dollars into savings and finally into additional goods and services that can flow through commerce with less debt. This will cause local banks to maintain a higher percentage of deposits relative to loans (bank reserves) which will cool down the economy in a less stressful manner than forcing inflationary interest costs into more and more retail items.

Instead of holding interest rates above inflation rates, (which results in systemic inflation), the percentage of down payments required for installment purchases should be increased during periods of inflation. This will route new dollars into savings and finally into additional goods and services that can flow through commerce with less debt. This will cause local banks to maintain a higher percentage of deposits relative to loans (bank reserves) which will cool down the economy in a less stressful manner than forcing inflationary interest costs into more and more retail items.

INTEREST AS A SOURCE OF ECONOMIC PROBLEMS

Controlling of the economy through the manipulation of interest rates has created non-repayable debt while reducing the profits that flow from production.

Controlling of the economy through the manipulation of interest rates has created non-repayable debt while reducing the profits that flow from production.

This has produced a system of perpetual debt expansion. Under the American monetary system, interest bearing credit is used for almost all new production, so interest is hidden in the cost of every item. This interest cost is pure inflation. It causes retail prices to rise and makes profits and economic growth impossible without perpetual debt expansion.

This has produced a system of perpetual debt expansion. Under the American monetary system, interest bearing credit is used for almost all new production, so interest is hidden in the cost of every item. This interest cost is pure inflation. It causes retail prices to rise and makes profits and economic growth impossible without perpetual debt expansion.

In 1993, total public and private debt expanded at twice the rate of National Income. A substantial part of this increase resulted from the compounding of interest. As a consequence, debt now grows at an annual rate much greater than the growth in National Income. However, when debt stops growing as it did in 1991, America suffered a recession. The only alternative is to monetize the value of production and labor.

In 1993, total public and private debt expanded at twice the rate of National Income. A substantial part of this increase resulted from the compounding of interest. As a consequence, debt now grows at an annual rate much greater than the growth in National Income. However, when debt stops growing as it did in 1991, America suffered a recession. The only alternative is to monetize the value of production and labor.

Realistically, the money borrowed to produce must be fully repaid (including the cost of labor and management) as each product flows through each stage of commerce. Otherwise, debt expansion must occur so products can be purchased and consumed and for businesses to maintain their administrative structure.

Realistically, the money borrowed to produce must be fully repaid (including the cost of labor and management) as each product flows through each stage of commerce. Otherwise, debt expansion must occur so products can be purchased and consumed and for businesses to maintain their administrative structure.

Borrowing to produce or consume a product or service doesn't automatically create the interest demanded when the note is due. Borrowing only creates the money actually borrowed but it always requires the borrower to repay an amount greater than the amount borrowed. So, the additional amount due upon repayment must come from prior savings or new profit, (economic expansion) This system makes debts harder and harder to repay as the economy becomes more debt dependent. This is the economy of the 21st century, an economy which suffers from too much debt and too little profit and not personal management flaws.

Borrowing to produce or consume a product or service doesn't automatically create the interest demanded when the note is due. Borrowing only creates the money actually borrowed but it always requires the borrower to repay an amount greater than the amount borrowed. So, the additional amount due upon repayment must come from prior savings or new profit, (economic expansion) This system makes debts harder and harder to repay as the economy becomes more debt dependent. This is the economy of the 21st century, an economy which suffers from too much debt and too little profit and not personal management flaws.

From a macro economic perspective, the interest portion of credit must be paid to the producer of goods and services when the consumer purchases the retail product or service. If consumers use borrowed money to purchase retail products and services, the interest cost does not get repaid, and the economic system creates interest driven debt expansion to survive. This debt expansion causes more interest to accumulate within the economy. This adds unearned income to the money supply and increases the cost of retail products at the same time. Thus a debt based monetary system demands the following:

From a macro economic perspective, the interest portion of credit must be paid to the producer of goods and services when the consumer purchases the retail product or service. If consumers use borrowed money to purchase retail products and services, the interest cost does not get repaid, and the economic system creates interest driven debt expansion to survive. This debt expansion causes more interest to accumulate within the economy. This adds unearned income to the money supply and increases the cost of retail products at the same time. Thus a debt based monetary system demands the following:

1. Perpetual credit expansion and currency debasement,

1. Perpetual credit expansion and currency debasement,

2. A national depression,

2. A national depression,

3. A continuous volume of foreclosures and bankruptcies to liquidate chattel into interest, which causes a loss of future National Income.

3. A continuous volume of foreclosures and bankruptcies to liquidate chattel into interest, which causes a loss of future National Income.