Chapter Five

Interest And Debt

In recent years, total debt has grown faster than the Gross Domestic Product. GDP is the market value of all goods and services. Nonetheless, profits can still be earned from more debt expansion because the money supply is continuously expanded. However, profits can no longer be earned at sufficient percentages within existing overall ratios of "profits" to "costs" to repay all the original principal debt and the interest as it comes due. This requires continuous debt expansion, business failures, and more borrowing. Therefore, compound interest charges build up in the economy. Today, the public debt (which is all government debt) and private debt (which is all investment, production and consumer debt) has become a continuously growing mountain for private enterprise to climb.

In recent years, total debt has grown faster than the Gross Domestic Product. GDP is the market value of all goods and services. Nonetheless, profits can still be earned from more debt expansion because the money supply is continuously expanded. However, profits can no longer be earned at sufficient percentages within existing overall ratios of "profits" to "costs" to repay all the original principal debt and the interest as it comes due. This requires continuous debt expansion, business failures, and more borrowing. Therefore, compound interest charges build up in the economy. Today, the public debt (which is all government debt) and private debt (which is all investment, production and consumer debt) has become a continuously growing mountain for private enterprise to climb.

THE PARADOX OF UN-EARNED INCOME

If the increased use of public and private debt and interest is so damaging, what about retired Americans who depend on the unearned income of Social Security or the interest payments generated by certificates of deposit and private pension plans?

If the increased use of public and private debt and interest is so damaging, what about retired Americans who depend on the unearned income of Social Security or the interest payments generated by certificates of deposit and private pension plans?

Elderly and retired individuals who depend on interest income from debt are not necessarily in a "Catch 22" situation. Conventional wisdom holds that every family unit rewarded from lower interest rates, and therefore burdened by less total debt to repay, is counterbalanced by other families who lose the unearned income needed to meet living expenses. This logic breaks down in a profitable private enterprise economy, because the individuals who pay living expenses with unearned income could receive even more income from dividends that resulted from profits on passive business investments. Obviously, the primary incentive for placing investment money is the anticipated rate of return, so let's review the incentives.

Elderly and retired individuals who depend on interest income from debt are not necessarily in a "Catch 22" situation. Conventional wisdom holds that every family unit rewarded from lower interest rates, and therefore burdened by less total debt to repay, is counterbalanced by other families who lose the unearned income needed to meet living expenses. This logic breaks down in a profitable private enterprise economy, because the individuals who pay living expenses with unearned income could receive even more income from dividends that resulted from profits on passive business investments. Obviously, the primary incentive for placing investment money is the anticipated rate of return, so let's review the incentives.

Graph 3.1 illustrates that the amount of personal dividend income is too low when compared to personal interest income, a reflection of overall low profitability in the economy .

Graph 3.1 illustrates that the amount of personal dividend income is too low when compared to personal interest income, a reflection of overall low profitability in the economy .

Graph 3.1

Graph 3.1 compares personal interest income to personal dividend income in constant 1987 dollars. Interest and dividend incentives were about equal during the 1946-50 period. Since then, the incentive gap has grown in favor of interest based investments by a factor of 6 to 1.

Graph 3.1 compares personal interest income to personal dividend income in constant 1987 dollars. Interest and dividend incentives were about equal during the 1946-50 period. Since then, the incentive gap has grown in favor of interest based investments by a factor of 6 to 1.

Stock brokers argue that returns on stock values (a stock's share value plus dividend value) are three times more profitable than interest returns. However, to access the higher returns, investors must depend on risky high growth mutual funds and become stock speculators.

Stock brokers argue that returns on stock values (a stock's share value plus dividend value) are three times more profitable than interest returns. However, to access the higher returns, investors must depend on risky high growth mutual funds and become stock speculators.

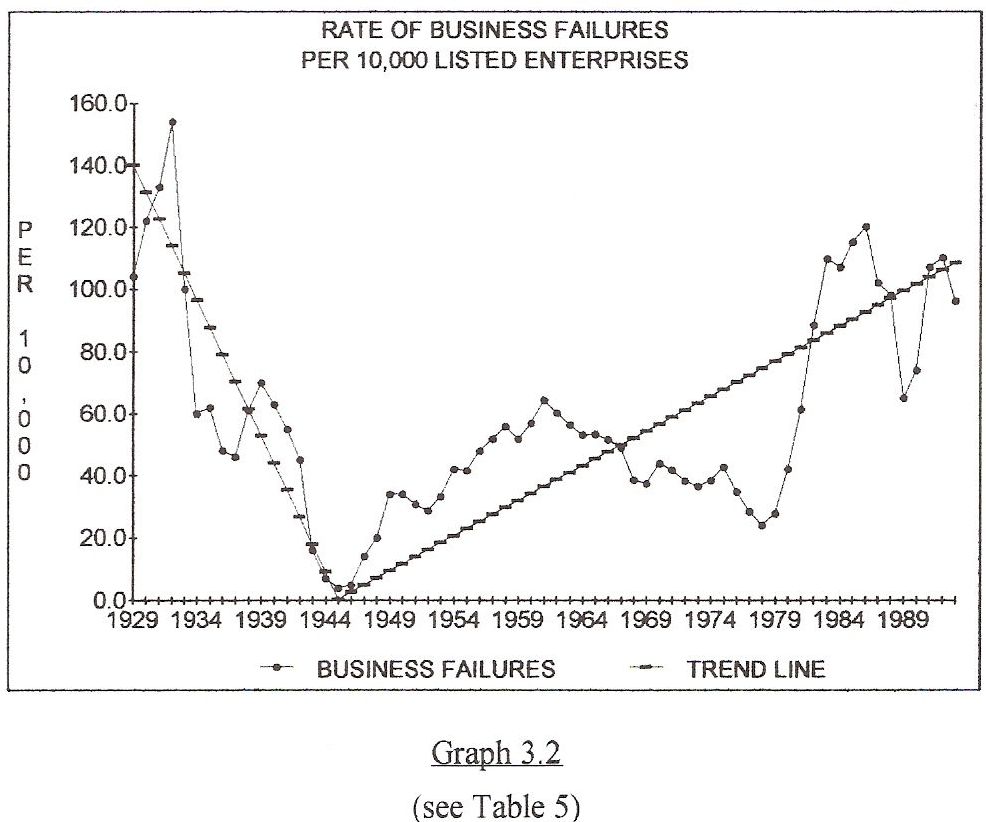

Graph 3.2 illustrates the growing rate of business failures that prevent many investors from investing cash in smaller businesses.

Graph 3.2 illustrates the growing rate of business failures that prevent many investors from investing cash in smaller businesses.

Graph 3.2

Click here to view (Table 5)

Graph 3.2 displays the growing percentage of new businesses failures. More new businesses would survive, and the economic pie (the National Income) would grow faster and thus increase dividends, if more payments to passive investors were extracted from profits and less payments were added to business cost as interest!

Graph 3.2 displays the growing percentage of new businesses failures. More new businesses would survive, and the economic pie (the National Income) would grow faster and thus increase dividends, if more payments to passive investors were extracted from profits and less payments were added to business cost as interest!

Changing these incentives has a positive impact on productivity because interest payments remove the capital needed during the early stages of business that would otherwise purchase new technology, maintain equipment, and pay labor. This money is needed for growth and competitiveness and should not be converted to unearned income.

Changing these incentives has a positive impact on productivity because interest payments remove the capital needed during the early stages of business that would otherwise purchase new technology, maintain equipment, and pay labor. This money is needed for growth and competitiveness and should not be converted to unearned income.

The private enterprise system is designed to create profits from investments. Disincentives for passive business investment and the lack of safety in the stock market conflict with this design.

The private enterprise system is designed to create profits from investments. Disincentives for passive business investment and the lack of safety in the stock market conflict with this design.

If America returns to an earned income system, and currency represents value instead of debt, the incentives for interest and stock investments will change dramatically. In fact, during the most recent structurally balanced period (1946-50), returns from interest and dividends were equal and business failures were low.

If America returns to an earned income system, and currency represents value instead of debt, the incentives for interest and stock investments will change dramatically. In fact, during the most recent structurally balanced period (1946-50), returns from interest and dividends were equal and business failures were low.

Graph 3.3

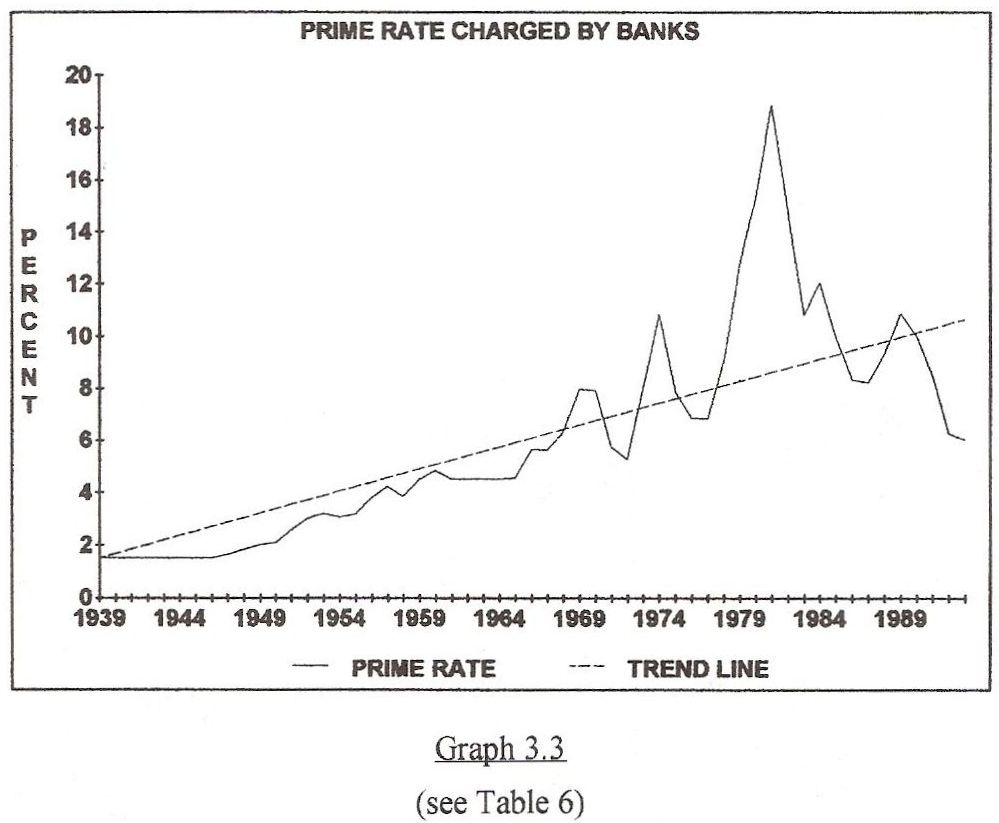

The prime rate of interest, is both a cause and a reflection of business failures. Graph 3.3 reflects a relatively stable prime rate before 1950, and a steady increase since 1950.

The prime rate of interest, is both a cause and a reflection of business failures. Graph 3.3 reflects a relatively stable prime rate before 1950, and a steady increase since 1950.

The straight line on the Graph is a mathematical long term computation of the overall trend. It was created by averaging the ups and downs into a computerized trend to clearly express the history of prime rates charged by banks. If this graph is overlaid on the rate of business failures or the interest and dividend income graph, a pattern of causation is discovered. As the prime rate of interest is increased, the incentives toward interest and away from dividends are increased. Also, as the prime rate is increased, the rate of business failures is increased.

The straight line on the Graph is a mathematical long term computation of the overall trend. It was created by averaging the ups and downs into a computerized trend to clearly express the history of prime rates charged by banks. If this graph is overlaid on the rate of business failures or the interest and dividend income graph, a pattern of causation is discovered. As the prime rate of interest is increased, the incentives toward interest and away from dividends are increased. Also, as the prime rate is increased, the rate of business failures is increased.

Under an earned income system of private enterprise, production has more value and debt has less value. This occurs through "raw materials monetization" and "debt de-monetization." As new earned wealth produces incentives that redirect investments, a dramatic change in trends will follow.

Under an earned income system of private enterprise, production has more value and debt has less value. This occurs through "raw materials monetization" and "debt de-monetization." As new earned wealth produces incentives that redirect investments, a dramatic change in trends will follow.

Over time, new business ventures will expand the economy without expanding debt and interest. Under this system, more dividends will be paid out of profits, after profits are created, instead of interest becoming cost, before profits are earned. Using dividends to repay more passive investors allows more businesses to survive during developmental stages. Interest however, always demands a full share of income even if the payment of interest contributes to the destruction of the business on which it depends.

Over time, new business ventures will expand the economy without expanding debt and interest. Under this system, more dividends will be paid out of profits, after profits are created, instead of interest becoming cost, before profits are earned. Using dividends to repay more passive investors allows more businesses to survive during developmental stages. Interest however, always demands a full share of income even if the payment of interest contributes to the destruction of the business on which it depends.

Graph 3.4

PRIVATE SECTOR INTEREST

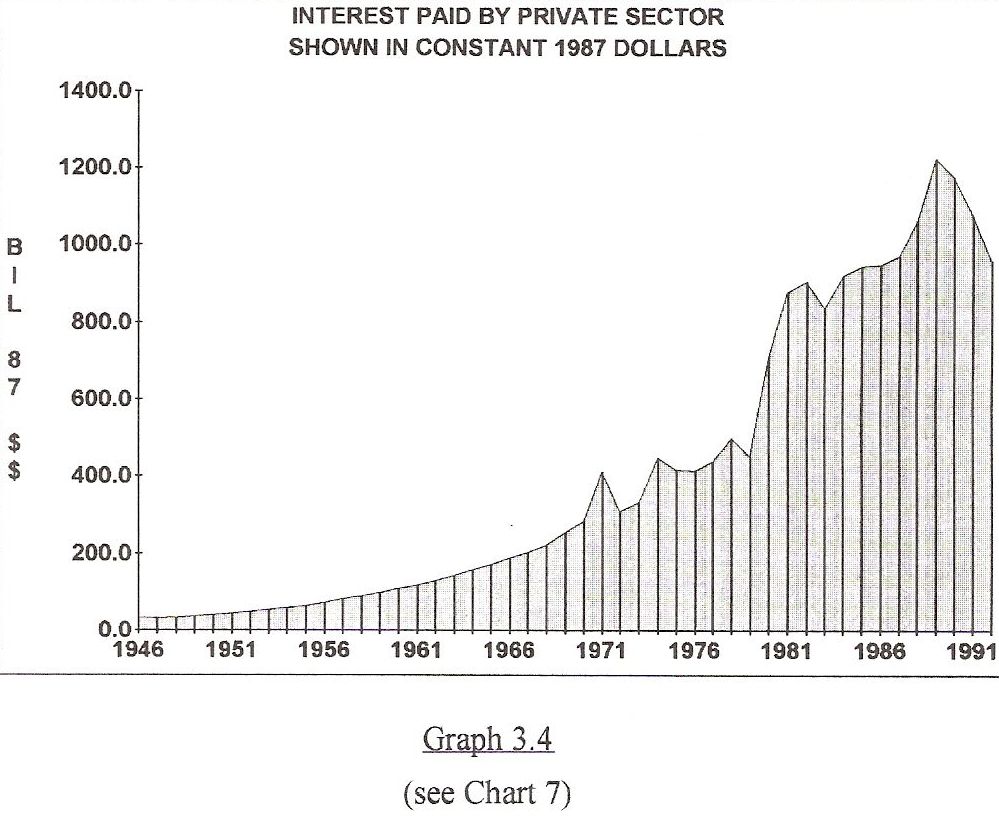

Graph 3.4 reflects private sector interest, or the interest earned and paid by private enterprise calculated in constant 1987 dollars. This is the carrying cost of debt. By comparing the first five years of the graph to the most recent five years, we uncover some very disturbing changes. From 1946 through 1950, the interest paid by domestic business averaged about $6.4 billion annually or 3% of National Income. During the years 1987 through 1991, business paid $1197.4 billion annually or 28.56% of National Income. As businesses entered the decade of the 1990's, they paid 10 times the interest (calculated as a percentage of National Income) that they paid 50 years ago. This is calculated in constant dollars which removes the effect of inflation from the numbers. This percentage will increase as long as the prime rate of interest is high; creating more incentives to bring money to the business community as interest bearing credit instead of dividend generating investments.

Graph 3.4 reflects private sector interest, or the interest earned and paid by private enterprise calculated in constant 1987 dollars. This is the carrying cost of debt. By comparing the first five years of the graph to the most recent five years, we uncover some very disturbing changes. From 1946 through 1950, the interest paid by domestic business averaged about $6.4 billion annually or 3% of National Income. During the years 1987 through 1991, business paid $1197.4 billion annually or 28.56% of National Income. As businesses entered the decade of the 1990's, they paid 10 times the interest (calculated as a percentage of National Income) that they paid 50 years ago. This is calculated in constant dollars which removes the effect of inflation from the numbers. This percentage will increase as long as the prime rate of interest is high; creating more incentives to bring money to the business community as interest bearing credit instead of dividend generating investments.

LOWERING LABOR COSTS TO INCREASE PROFITS

The growth of private sector interest reflects the growing debt that's used to generate economic growth. The growth in private sector interest is partially the result of maintaining interest rates far above the inflation rate; giving value to money above its value as a medium of exchange and beyond its ability to store value. The other factor is both a cause and effect of higher interest rates. This other factor is the internal imbalance between segments of the economy. It will be explored in future chapters. Together, these factors cause a debt burden on non-financial business that reduces the profits of private enterprise. This problem will worsen as interest continues to compound and prices remain out of balance; causing profits as a percentage of National Income to fall even more.

The growth of private sector interest reflects the growing debt that's used to generate economic growth. The growth in private sector interest is partially the result of maintaining interest rates far above the inflation rate; giving value to money above its value as a medium of exchange and beyond its ability to store value. The other factor is both a cause and effect of higher interest rates. This other factor is the internal imbalance between segments of the economy. It will be explored in future chapters. Together, these factors cause a debt burden on non-financial business that reduces the profits of private enterprise. This problem will worsen as interest continues to compound and prices remain out of balance; causing profits as a percentage of National Income to fall even more.

There is a temporary counterbalance to this problem that does not require the de-monetization of debt or the monetization of raw materials. If national policies or international treaties lower wages, salaries and supplements to wages, the current imbalanced economic structure can be extended further into the future, at the expense of labor. In other words, decreasing the cost of labor and decreasing the cost of supplements to labor (such as health care) will temporarily increase profits, but this will depress overall growth. This explains the attention given to labor productivity under the banner of "competing in a world economy." This also explains much of the attention given the rising health care costs. Lowering the cost of labor to increase the profits of private enterprise lowers the standard of living of American workers. This further stratifies the economic classes by reducing domestic consumption. It ultimately stalls growth and the development of new technologies.

There is a temporary counterbalance to this problem that does not require the de-monetization of debt or the monetization of raw materials. If national policies or international treaties lower wages, salaries and supplements to wages, the current imbalanced economic structure can be extended further into the future, at the expense of labor. In other words, decreasing the cost of labor and decreasing the cost of supplements to labor (such as health care) will temporarily increase profits, but this will depress overall growth. This explains the attention given to labor productivity under the banner of "competing in a world economy." This also explains much of the attention given the rising health care costs. Lowering the cost of labor to increase the profits of private enterprise lowers the standard of living of American workers. This further stratifies the economic classes by reducing domestic consumption. It ultimately stalls growth and the development of new technologies.

PUBLIC SECTOR INTEREST

Table 8 depicts the public sector interest paid since 1962, or the interest paid on government deficits. In 1994, American's paid almost 300 Billion Dollars for interest on instruments of public debt. This was 100 Billion Dollars more than farmers and ranchers were paid for all the food and fiber they produced. It was also 150 Billion Dollars more than the first point of sale "natural" value of all the oil, coal, and natural gas used that year. This means the cost of interest was 150 Billion Dollars more than the price of all crude petroleum products used in America, even if the price of oil had been raised to a $35 per barrel (a computation of the intrinsic value which will be examined later).

Table 8 depicts the public sector interest paid since 1962, or the interest paid on government deficits. In 1994, American's paid almost 300 Billion Dollars for interest on instruments of public debt. This was 100 Billion Dollars more than farmers and ranchers were paid for all the food and fiber they produced. It was also 150 Billion Dollars more than the first point of sale "natural" value of all the oil, coal, and natural gas used that year. This means the cost of interest was 150 Billion Dollars more than the price of all crude petroleum products used in America, even if the price of oil had been raised to a $35 per barrel (a computation of the intrinsic value which will be examined later).

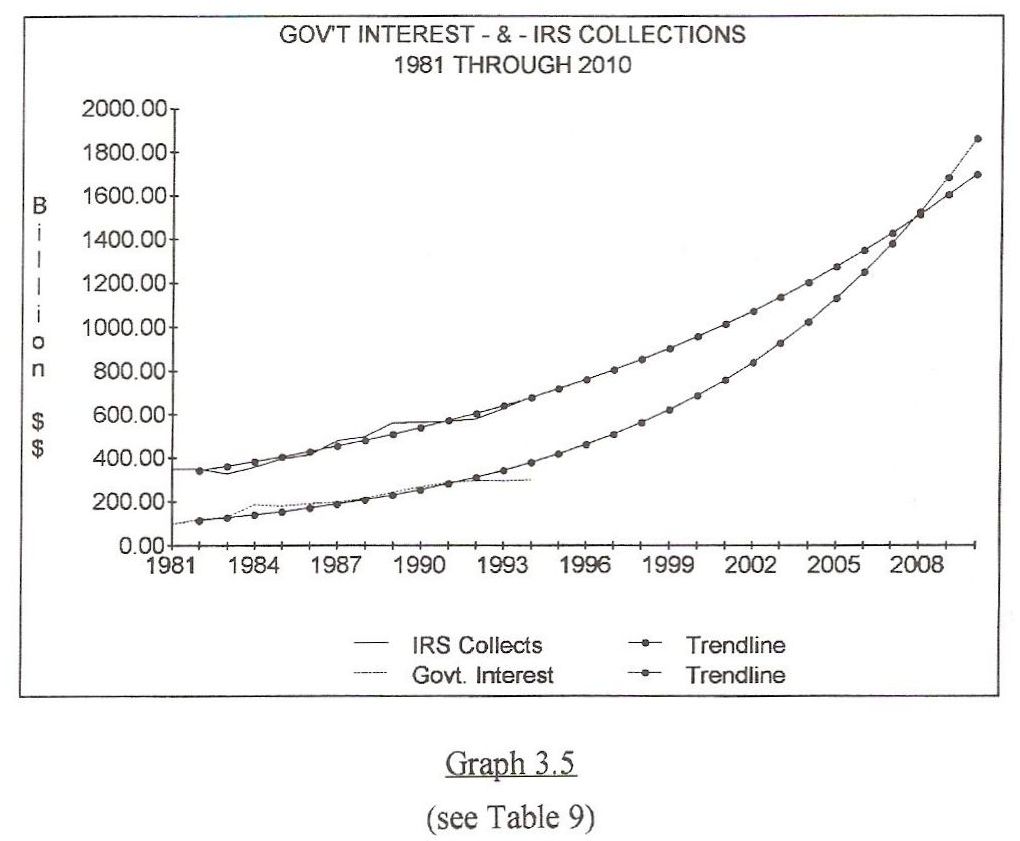

The accumulated government debt is disturbing. Several projections have been made regarding public sector interest using historical government statistics. These projections show that if budget deficits continue, the interest cost on the government debt will absorb all IRS collections within the next two decades!

The accumulated government debt is disturbing. Several projections have been made regarding public sector interest using historical government statistics. These projections show that if budget deficits continue, the interest cost on the government debt will absorb all IRS collections within the next two decades!

Graph 3.5

COLLECTING TAXES TO PAY GOVERNMENT INTEREST

Graph 3.5 shows that since 1981, interest on government debt has been increasing twice as fast as IRS collections. On average, government debt has increased by approximately 10% per year since 1981 while IRS collections have increased less than 5% per year. If IRS collections had kept pace with government debt expansion from 1981 through 1992, another 283.3 Billion Dollars in taxes would have been collected.

Graph 3.5 shows that since 1981, interest on government debt has been increasing twice as fast as IRS collections. On average, government debt has increased by approximately 10% per year since 1981 while IRS collections have increased less than 5% per year. If IRS collections had kept pace with government debt expansion from 1981 through 1992, another 283.3 Billion Dollars in taxes would have been collected.

This under-taxation or increased deficit spending averaged 23.6 Billion Dollars per year during the 1981-92 period and more than 30 Billion Dollars in 1992 alone. This amount of tax deferral or deficit spending should create an economic stimulus program, yet the records reflect expanded debt and sporadic growth during the period.

This under-taxation or increased deficit spending averaged 23.6 Billion Dollars per year during the 1981-92 period and more than 30 Billion Dollars in 1992 alone. This amount of tax deferral or deficit spending should create an economic stimulus program, yet the records reflect expanded debt and sporadic growth during the period.

Unless Congress acts, taxpayers will eventually be forced to pay income tax for the sole purpose of servicing the interest on public debt. At that point, the government will tax one class of people for the sole purpose of forwarding the taxes to another class of people in the form of unearned income. The federal budget as a usable instrument will then cease to exist. This ridiculous scenario is statistically possible. Feudalism will have come to America!

Unless Congress acts, taxpayers will eventually be forced to pay income tax for the sole purpose of servicing the interest on public debt. At that point, the government will tax one class of people for the sole purpose of forwarding the taxes to another class of people in the form of unearned income. The federal budget as a usable instrument will then cease to exist. This ridiculous scenario is statistically possible. Feudalism will have come to America!

This trend is demonstrated by the two pie charts. In 1962, the interest on public debt consumed about 8.5% of the Federal Budget. In 1994, interest had grown to 20% of the budget, and exceeded defense spending for the first time. In the 1994 budget, "other" spending is almost non existent. Institutionalized social programs and interest on government debt have consumed the flexibility of the Federal Budget.

This trend is demonstrated by the two pie charts. In 1962, the interest on public debt consumed about 8.5% of the Federal Budget. In 1994, interest had grown to 20% of the budget, and exceeded defense spending for the first time. In the 1994 budget, "other" spending is almost non existent. Institutionalized social programs and interest on government debt have consumed the flexibility of the Federal Budget.

A growing public debt demands that taxes be increased or spending be reduced. In a low growth, unbalanced economy, both options are detrimental.

A growing public debt demands that taxes be increased or spending be reduced. In a low growth, unbalanced economy, both options are detrimental.

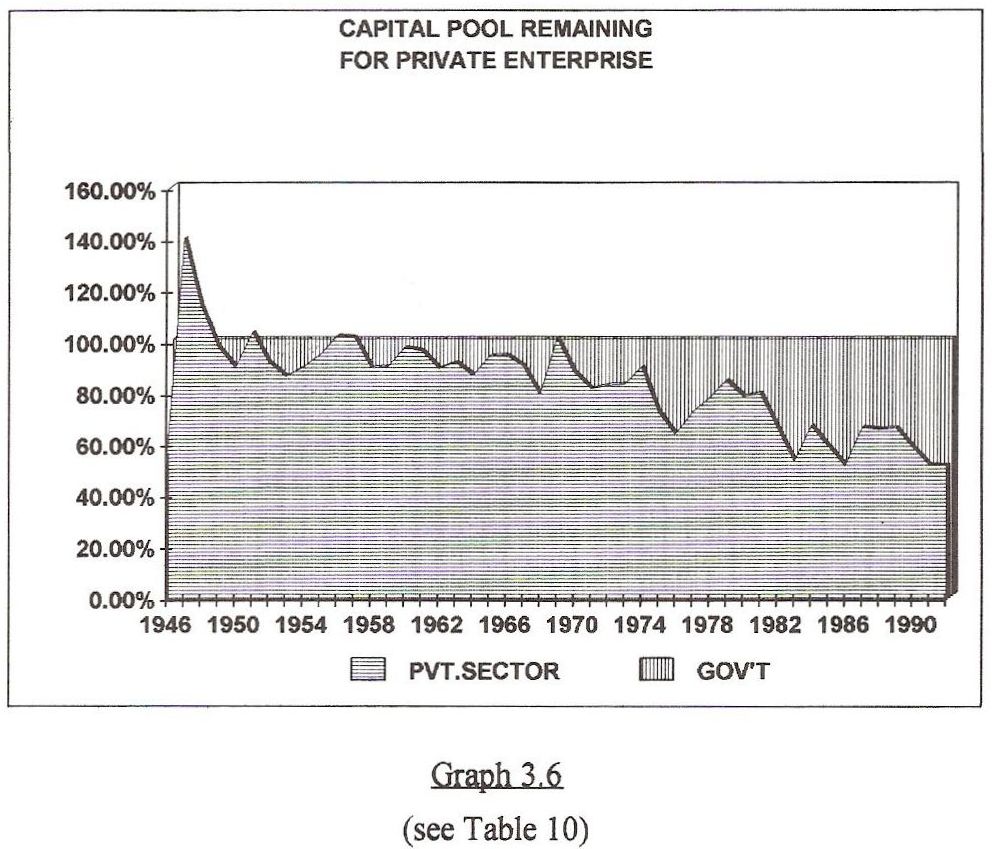

Graph 3.6

DRAINING THE CAPITAL POOL

Graph 3.6 describes the amount of capital removed from the private sector by government borrowing and the amount remaining for private enterprise to re-invest. This Graph covers the years 1946 through 1992.

Graph 3.6 describes the amount of capital removed from the private sector by government borrowing and the amount remaining for private enterprise to re-invest. This Graph covers the years 1946 through 1992.

The "Capital Pool" is a combination of several sources of liquidity.

The "Capital Pool" is a combination of several sources of liquidity.

They are:

They are:

(1) Corporate Profits,

(1) Corporate Profits,

(2) Net Interest Income, and

(2) Net Interest Income, and

(3) Rental Income.

(3) Rental Income.

These incomes are three of the five segments of National Income.

These incomes are three of the five segments of National Income.

During the most recent five year period, 1989 through 1993, an average of 41.5% of these private capital earnings were diverted to government borrowing. In recent history, government borrowing was substantially reduced only during the structurally balanced period of 1947-48-49. Then the economy could exchange its annual production of goods and services without the necessity for government debt expansion.

During the most recent five year period, 1989 through 1993, an average of 41.5% of these private capital earnings were diverted to government borrowing. In recent history, government borrowing was substantially reduced only during the structurally balanced period of 1947-48-49. Then the economy could exchange its annual production of goods and services without the necessity for government debt expansion.

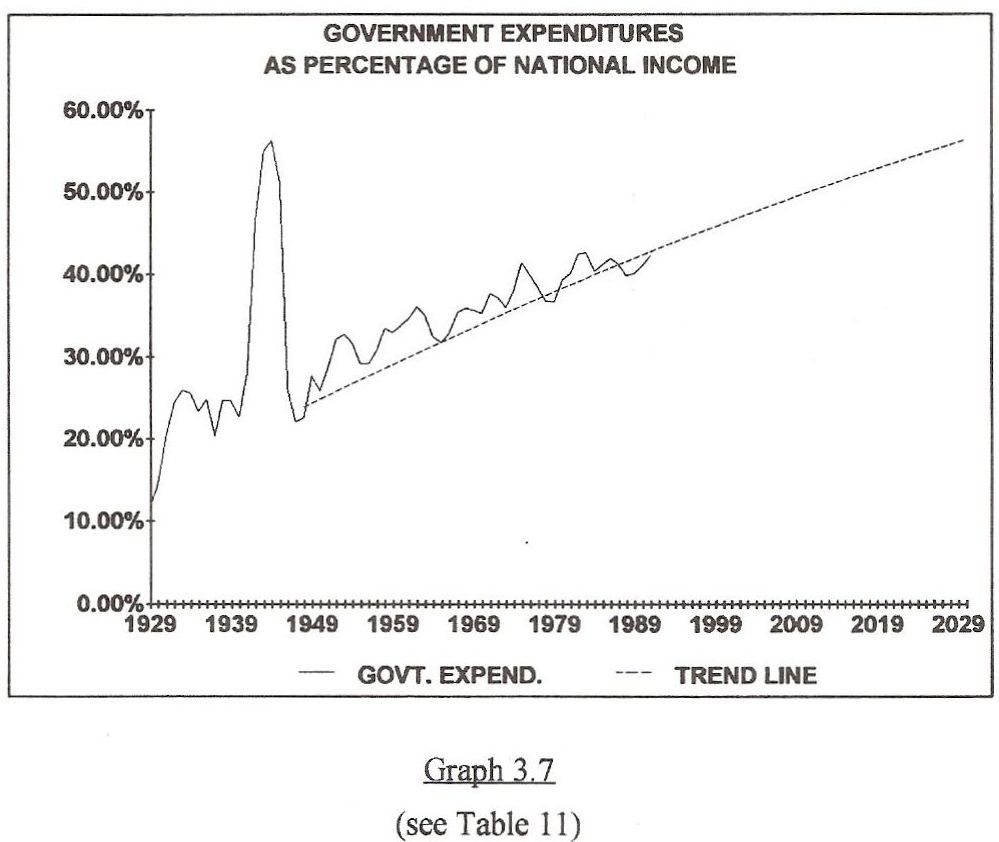

Graph 3.7

Graph 3.7 reflects the effect of excess government spending. It reflects an economy out of balance with itself and government's attempt to compensate by removing National Income from the private sector while it tries to assist the private sector.

Graph 3.7 reflects the effect of excess government spending. It reflects an economy out of balance with itself and government's attempt to compensate by removing National Income from the private sector while it tries to assist the private sector.

Increased government spending designed to stimulate economic growth and increase National Income isn't yielding expected results. The economic pump is becoming too difficult to prime.

Increased government spending designed to stimulate economic growth and increase National Income isn't yielding expected results. The economic pump is becoming too difficult to prime.

A BALANCED BUDGET AMENDMENT TO THE U. S. CONSTITUTION

One "solution" to the growing public debt is a balanced budget amendment to the Constitution. This plan is proposed by those most immune to problems resulting from such actions.

One "solution" to the growing public debt is a balanced budget amendment to the Constitution. This plan is proposed by those most immune to problems resulting from such actions.

A balanced budget amendment will allow America to fall into a depression because economic imbalances won't be camouflaged by transfer payments.

A balanced budget amendment will allow America to fall into a depression because economic imbalances won't be camouflaged by transfer payments.

A balanced budget amendment ignores the primary role of government. Government is not in business to make a profit. Government is a non-profit corporation comprised of a chairman (the President), a board of directors (the Congress), a staff (the Cabinet), and employees (the Bureaucracy) This governing corporation must fairly balance every personal initiative, with the hopes and dreams of other citizens. It must function similar to counterweights inside an automobile engine. If counterweights are removed, an engine will self destruct. A balanced budget amendment caps entitlements to the disadvantaged while ignoring public and private debt expansion, or the interest on public debt, or unrestricted imports. This will debilitate the lower classes, and benefit the wealthy. A balanced budget law converts government into a for profit corporation. It removes the counterweights from the engine.

A balanced budget amendment ignores the primary role of government. Government is not in business to make a profit. Government is a non-profit corporation comprised of a chairman (the President), a board of directors (the Congress), a staff (the Cabinet), and employees (the Bureaucracy) This governing corporation must fairly balance every personal initiative, with the hopes and dreams of other citizens. It must function similar to counterweights inside an automobile engine. If counterweights are removed, an engine will self destruct. A balanced budget amendment caps entitlements to the disadvantaged while ignoring public and private debt expansion, or the interest on public debt, or unrestricted imports. This will debilitate the lower classes, and benefit the wealthy. A balanced budget law converts government into a for profit corporation. It removes the counterweights from the engine.

BUDGET DEFICIT "CURES"

A budget deficit "cure" could logically impact the "advantaged" or the "working wealthy." One cure would be to declare an interest moratorium (on public debt service), and apply all payments on public debt to the principal. For this "cure" to work, the President must declare a national emergency and with the cooperation of Congress, issue an order allowing holders of public debt, (excluding the banking system) to receive tax incentives, or items of tangible public wealth (such as raw government land or vacant government buildings) in exchange for foregoing interest payments. This could be especially important in western states where much of the land is now owned by government. This land could be sold back to each of the states' government.

A budget deficit "cure" could logically impact the "advantaged" or the "working wealthy." One cure would be to declare an interest moratorium (on public debt service), and apply all payments on public debt to the principal. For this "cure" to work, the President must declare a national emergency and with the cooperation of Congress, issue an order allowing holders of public debt, (excluding the banking system) to receive tax incentives, or items of tangible public wealth (such as raw government land or vacant government buildings) in exchange for foregoing interest payments. This could be especially important in western states where much of the land is now owned by government. This land could be sold back to each of the states' government.

Budget deficits can be reduced by issuing United States Notes. If non-interest bearing United States Notes paid the interest on public debt, the money supply would be expanded by that amount and bank reserve requirements could be adjusted upward to offset the new money so it couldn't be converted into debt. This would reduce the expansion of public debt. This cure must be applied carefully to avoid hyper-inflation. Hyper-inflation can occur unless increases in commercial bank reserves and increased down payment requirements on installment purchases are mandated at a level sufficient to offset the impact of the new money.

Budget deficits can be reduced by issuing United States Notes. If non-interest bearing United States Notes paid the interest on public debt, the money supply would be expanded by that amount and bank reserve requirements could be adjusted upward to offset the new money so it couldn't be converted into debt. This would reduce the expansion of public debt. This cure must be applied carefully to avoid hyper-inflation. Hyper-inflation can occur unless increases in commercial bank reserves and increased down payment requirements on installment purchases are mandated at a level sufficient to offset the impact of the new money.

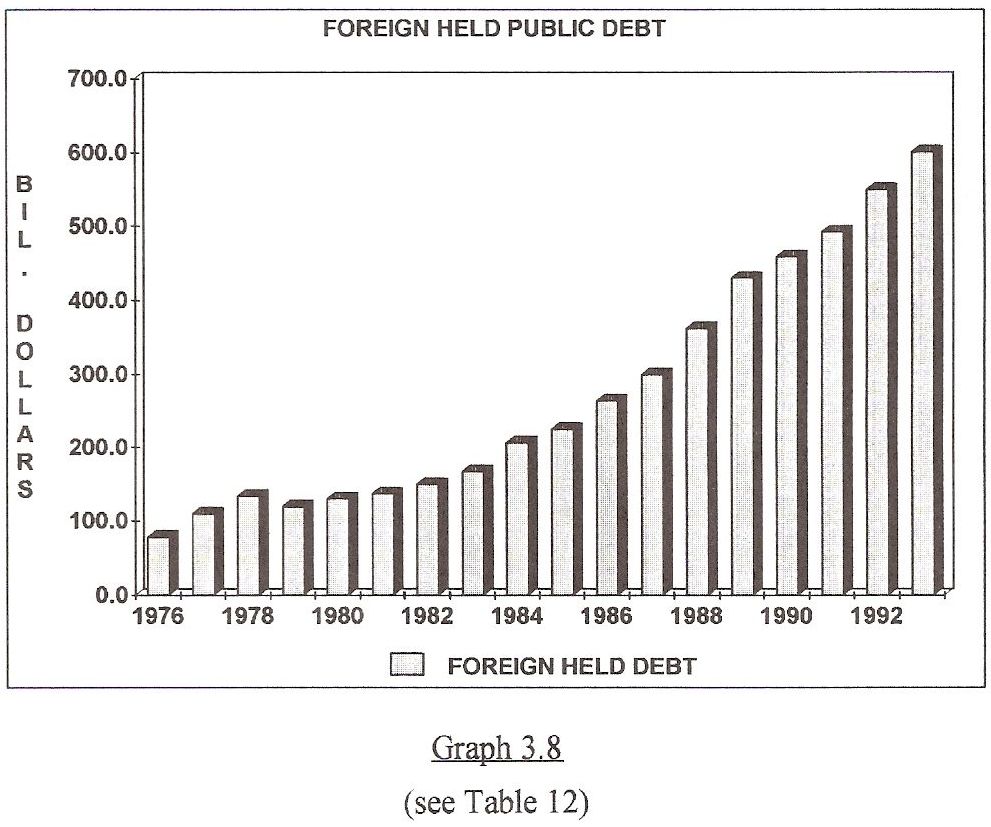

Graph 3.8

PAYING FOREIGN HELD DEBT

Graph 3.8 depicts America's increasing debt to other countries. The federal budget deficit could be legitimately reduced by paying off foreign debt with currency created by the Treasury Department. In the long term, if America paid its foreign debt with Treasury issued United States Notes, or some other form of national money that's redeemable through taxation, 40 Billion Dollars in annual interest payments that now leave America each year would stay at home. The current public debt, both foreign and domestic is displayed on the next Graph.

Graph 3.8 depicts America's increasing debt to other countries. The federal budget deficit could be legitimately reduced by paying off foreign debt with currency created by the Treasury Department. In the long term, if America paid its foreign debt with Treasury issued United States Notes, or some other form of national money that's redeemable through taxation, 40 Billion Dollars in annual interest payments that now leave America each year would stay at home. The current public debt, both foreign and domestic is displayed on the next Graph.

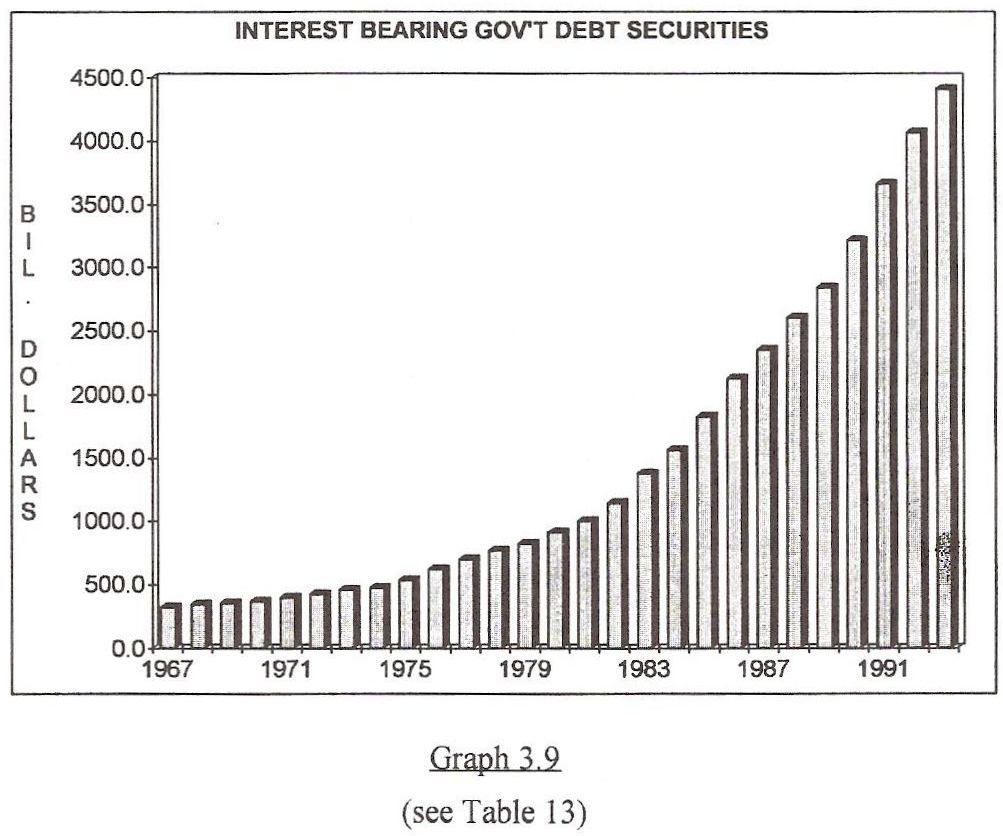

Graph 3.9

The payment of foreign held public debts with United States Notes will generate immediate demand for American produced products in creditor countries, if, as a pre-requisite to accepting payment, the government of each creditor country is required to purchase American exports with the money paid to their citizens or to their national treasury. This will expand exports with American money, and this money will return to America with each purchase. As United States Notes are returned to America, they will reduce domestic inventories and generate the production and consumption of more goods and services. This will lower total unemployment.

The payment of foreign held public debts with United States Notes will generate immediate demand for American produced products in creditor countries, if, as a pre-requisite to accepting payment, the government of each creditor country is required to purchase American exports with the money paid to their citizens or to their national treasury. This will expand exports with American money, and this money will return to America with each purchase. As United States Notes are returned to America, they will reduce domestic inventories and generate the production and consumption of more goods and services. This will lower total unemployment.

American depository banks must allow this new money to increase their checkable deposits by a substantial percentage of the newly arriving United States Notes. These new dollars should never be consumed by fractional lending which will convert their value to debt. United States Notes function as interest free legal tender and they should never be converted into debt. Safeguarding United States Notes requires an upward adjustment of bank reserves and a reduction in consumer credit through increased down payments.

American depository banks must allow this new money to increase their checkable deposits by a substantial percentage of the newly arriving United States Notes. These new dollars should never be consumed by fractional lending which will convert their value to debt. United States Notes function as interest free legal tender and they should never be converted into debt. Safeguarding United States Notes requires an upward adjustment of bank reserves and a reduction in consumer credit through increased down payments.

This will make the dollar stronger as foreign interest payments now totaling over 40 Billion Dollars per year are eliminated.

This will make the dollar stronger as foreign interest payments now totaling over 40 Billion Dollars per year are eliminated.

IGNORE THE PUBLIC DEBT?

What happens if public debt continues to expand, and the profitability of the private enterprise system continues to deteriorate? AFTER ALL, WE OWE MOST OF THIS DEBT TO OURSELVES!

What happens if public debt continues to expand, and the profitability of the private enterprise system continues to deteriorate? AFTER ALL, WE OWE MOST OF THIS DEBT TO OURSELVES!

If the US Congress and the American people continue to ignore the public debt, it will continue to grow as a percentage of National Income and eventually, the securities dealers who market this debt won't be able to sell it to institutions, wealthy citizens and foreigners. Consequently, the Federal Reserve will purchase unprecedented amounts of government debt, thus expanding the money supply by the same amount. This is a direct path to hyper-inflation if the economy is not re-balanced in the process. As interest and debt grow as a percentage of National Income, this probability looms higher on the horizon.

If the US Congress and the American people continue to ignore the public debt, it will continue to grow as a percentage of National Income and eventually, the securities dealers who market this debt won't be able to sell it to institutions, wealthy citizens and foreigners. Consequently, the Federal Reserve will purchase unprecedented amounts of government debt, thus expanding the money supply by the same amount. This is a direct path to hyper-inflation if the economy is not re-balanced in the process. As interest and debt grow as a percentage of National Income, this probability looms higher on the horizon.

Today, the interest on public debt is growing as a percentage of tax collections. As public debt grows as a percentage of Domestic Wealth, a higher interest rate must be offered on public debt to attract enough money to cover the government's operating loss.

Today, the interest on public debt is growing as a percentage of tax collections. As public debt grows as a percentage of Domestic Wealth, a higher interest rate must be offered on public debt to attract enough money to cover the government's operating loss.

Hyper-inflation can occur if government is forced to internalize debt to subsidize massive budgetary shortfalls because this fiat money enters a domestic economy far detached from any tangible value. This fiat injection is more inflationary than the predetermined application of United States Notes because monetized debt can float around the service economy and raise prices without generating new wealth or attaching itself to new wealth. So, the nation can be spun out of control by hyper-inflation instead of grinding to a halt under the burden of interest.

Hyper-inflation can occur if government is forced to internalize debt to subsidize massive budgetary shortfalls because this fiat money enters a domestic economy far detached from any tangible value. This fiat injection is more inflationary than the predetermined application of United States Notes because monetized debt can float around the service economy and raise prices without generating new wealth or attaching itself to new wealth. So, the nation can be spun out of control by hyper-inflation instead of grinding to a halt under the burden of interest.

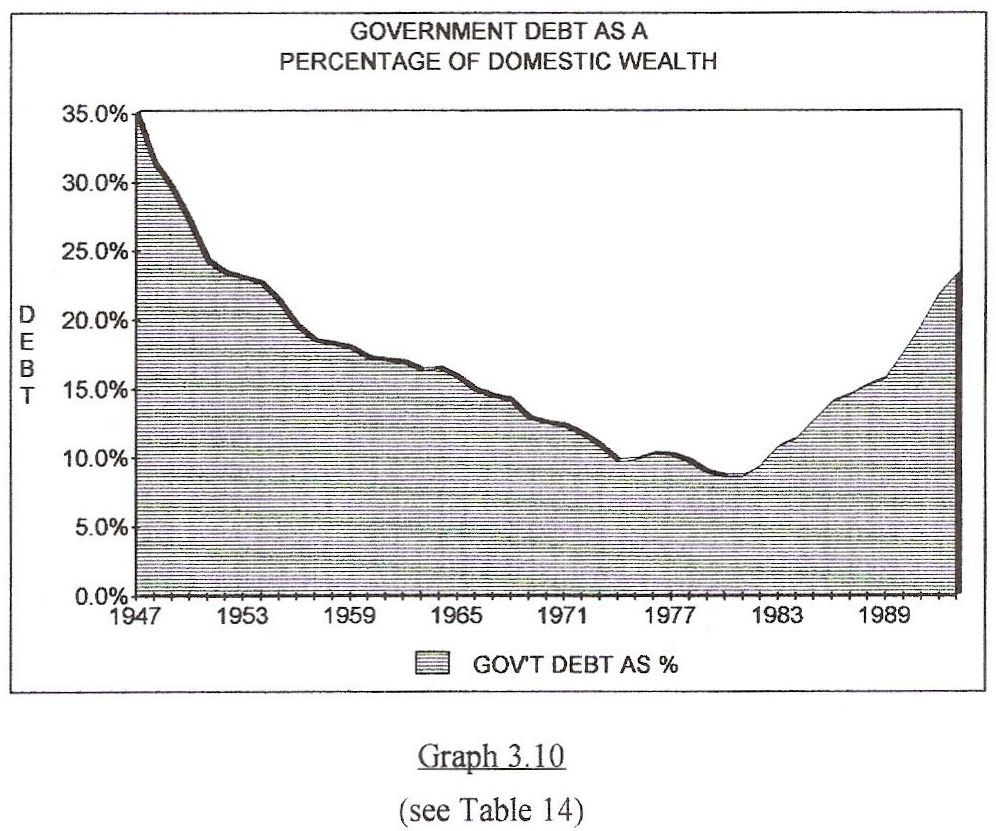

Graph 3.10

COMPARING GOVERNMENT DEBT TO DOMESTIC WEALTH

Graph 3.10 displays the historical ratio of Public Debt to Domestic Wealth. Domestic Wealth is defined as the current replacement value of all domestic tangible assets.

Graph 3.10 displays the historical ratio of Public Debt to Domestic Wealth. Domestic Wealth is defined as the current replacement value of all domestic tangible assets.

The ratio of government debt to domestic wealth has been worsening each year after reaching a peak of $12.83 of wealth to every $1.00 of debt in 1980. Debt as a portion of Domestic Wealth has increased by 256.5% since 1980.

The ratio of government debt to domestic wealth has been worsening each year after reaching a peak of $12.83 of wealth to every $1.00 of debt in 1980. Debt as a portion of Domestic Wealth has increased by 256.5% since 1980.

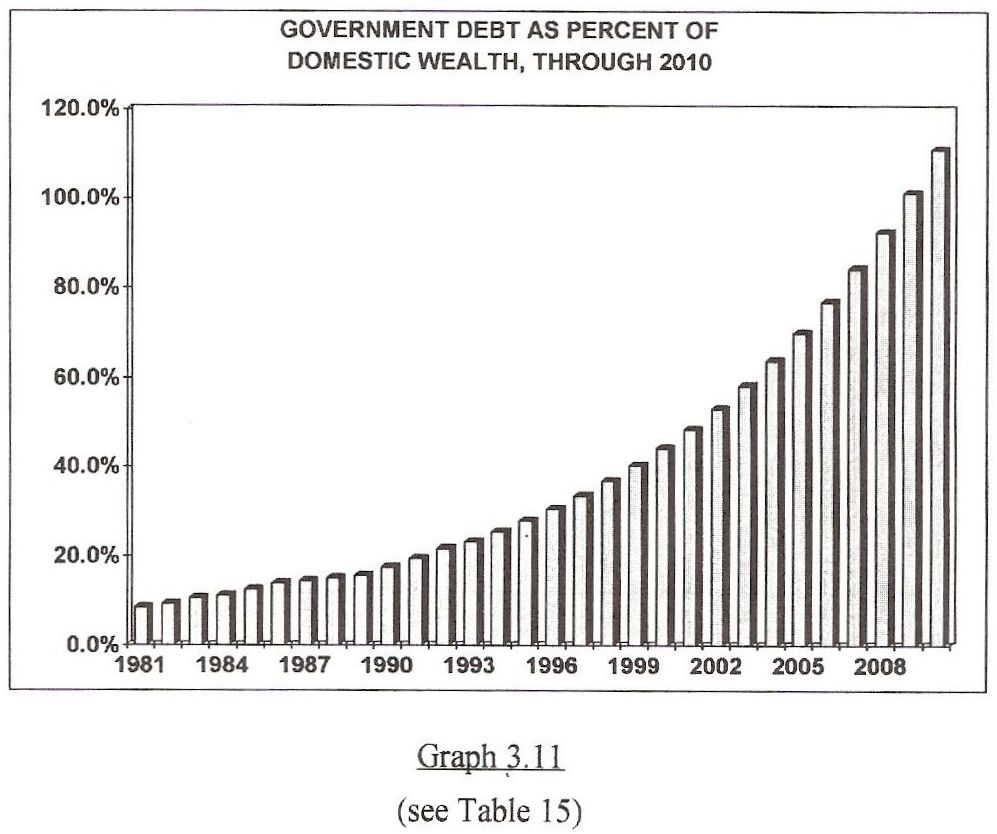

Graph 3.11

GOVERNMENT DEBT AS A PERCENTAGE OF DOMESTIC WEALTH PROJECTED THROUGH 2010

Graph 3.11 projects the percentage of domestic wealth consumed by government debt through the year 2010 using the most recent 10 year trend lines as a basis for projections. This proves if trends don't change, within 15 years, American's will be required to pay interest on all Domestic Wealth, because our public debt will exceed the value of all Domestic Wealth by the year 2008.

Graph 3.11 projects the percentage of domestic wealth consumed by government debt through the year 2010 using the most recent 10 year trend lines as a basis for projections. This proves if trends don't change, within 15 years, American's will be required to pay interest on all Domestic Wealth, because our public debt will exceed the value of all Domestic Wealth by the year 2008.

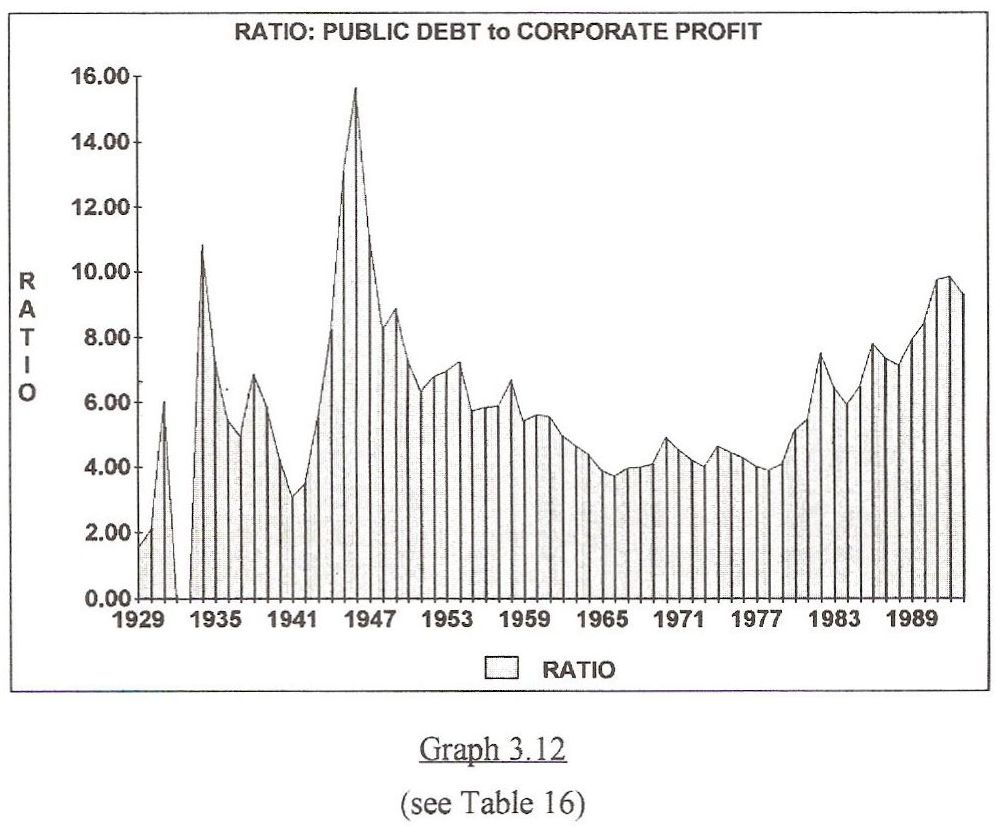

Graph 3.12

CORPORATE PROFITS AND GOVERNMENT DEBT

The ratio of public debt to corporate profits has reached a post WWII high. A ratio of more than 10 Dollars of government debt to each Dollar of corporate profit demonstrates that America is suffering the effects of increased government debt.

The ratio of public debt to corporate profits has reached a post WWII high. A ratio of more than 10 Dollars of government debt to each Dollar of corporate profit demonstrates that America is suffering the effects of increased government debt.

THE SOCIAL SECURITY TRUST FUND AND GOVERNMENT DEBT

Transferring additional wage taxes to the general fund and less to social security by "means testing" recipients can in theory reduce the budget deficit. Proponents of this "cure" would curtail payments to persons with individual incomes above levels earned by the average skilled urban laborer, and shift this savings into the general fund. This impacts the oldest and wealthiest Americans by eliminating their benefits if they earn more than $25,000 annually.

Transferring additional wage taxes to the general fund and less to social security by "means testing" recipients can in theory reduce the budget deficit. Proponents of this "cure" would curtail payments to persons with individual incomes above levels earned by the average skilled urban laborer, and shift this savings into the general fund. This impacts the oldest and wealthiest Americans by eliminating their benefits if they earn more than $25,000 annually.

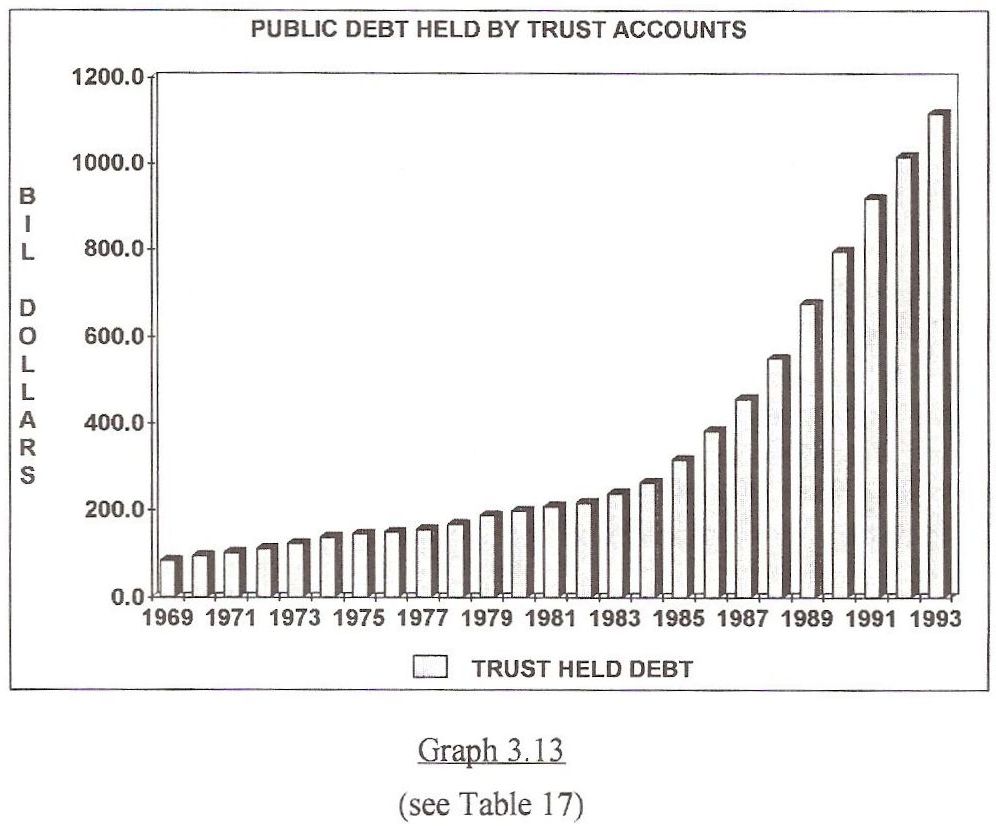

Graph 3.13

BORROWING THE SOCIAL SECURITY TRUST FUND

More than 1.2 Trillion Dollars has been borrowed from the Social Security Trust Fund to help offset federal budget deficits. By design, the Social Security Trust Fund is a big IOU that is continuously spent by government because current law demands that Social Security Trust funds be used to purchase government debt.

More than 1.2 Trillion Dollars has been borrowed from the Social Security Trust Fund to help offset federal budget deficits. By design, the Social Security Trust Fund is a big IOU that is continuously spent by government because current law demands that Social Security Trust funds be used to purchase government debt.

As government borrows money from Social Security to cover operating losses, it pays interest to the fund. These interest payments total over 70 Billion Dollars per year. In essence, the government borrows social security withholdings to offset a shortage of other forms of tax collections.

As government borrows money from Social Security to cover operating losses, it pays interest to the fund. These interest payments total over 70 Billion Dollars per year. In essence, the government borrows social security withholdings to offset a shortage of other forms of tax collections.

Paying interest to the Social Security Trust Fund is a poor way to maintain the fund. It's a "slight of hand," because it increases the budget deficit. The interest paid to Social Security from the General Fund causes the government to dip further into Social Security. This obligates the government to pay more interest to the fund.

Paying interest to the Social Security Trust Fund is a poor way to maintain the fund. It's a "slight of hand," because it increases the budget deficit. The interest paid to Social Security from the General Fund causes the government to dip further into Social Security. This obligates the government to pay more interest to the fund.

Instead, the Social Security Trust Fund should be viewed on a cash in - cash out basis, because paying interest only produces a circle of borrowing. If government must borrow, it's ludicrous to pay interest to the fund, causing the budget deficit to increase by that same amount which places further demands on the fund!

Instead, the Social Security Trust Fund should be viewed on a cash in - cash out basis, because paying interest only produces a circle of borrowing. If government must borrow, it's ludicrous to pay interest to the fund, causing the budget deficit to increase by that same amount which places further demands on the fund!

As an alternative, the Treasury Department should issue United States Notes to the Trust Fund in an amount equal to the interest due the Fund. This would expand the money supply. The reserve requirements of depository banks should be increased by that amount so as the new money finds its way into the private sector, it won't be converted into debt and become inflationary.

As an alternative, the Treasury Department should issue United States Notes to the Trust Fund in an amount equal to the interest due the Fund. This would expand the money supply. The reserve requirements of depository banks should be increased by that amount so as the new money finds its way into the private sector, it won't be converted into debt and become inflationary.

The federal government should never pay interest to the Social Security Trust Fund, or to the Federal Reserve System, on the faith and credit it must create to benefit the population. Such logic suggests that certain private entities are more credit worthy than the sovereign government.

The federal government should never pay interest to the Social Security Trust Fund, or to the Federal Reserve System, on the faith and credit it must create to benefit the population. Such logic suggests that certain private entities are more credit worthy than the sovereign government.

Government borrowing is futile. When the government borrows and pays interest, it is forced to inflate the money supply and levy taxes to pay the bill. When it administers the tax system, it automatically adds the cost of administration to the process. If it creates credit through the Federal Reserve System, it creates interest and debt which produces unearned interest income. This flawed system is the cornerstone of United States government financing.

Government borrowing is futile. When the government borrows and pays interest, it is forced to inflate the money supply and levy taxes to pay the bill. When it administers the tax system, it automatically adds the cost of administration to the process. If it creates credit through the Federal Reserve System, it creates interest and debt which produces unearned interest income. This flawed system is the cornerstone of United States government financing.

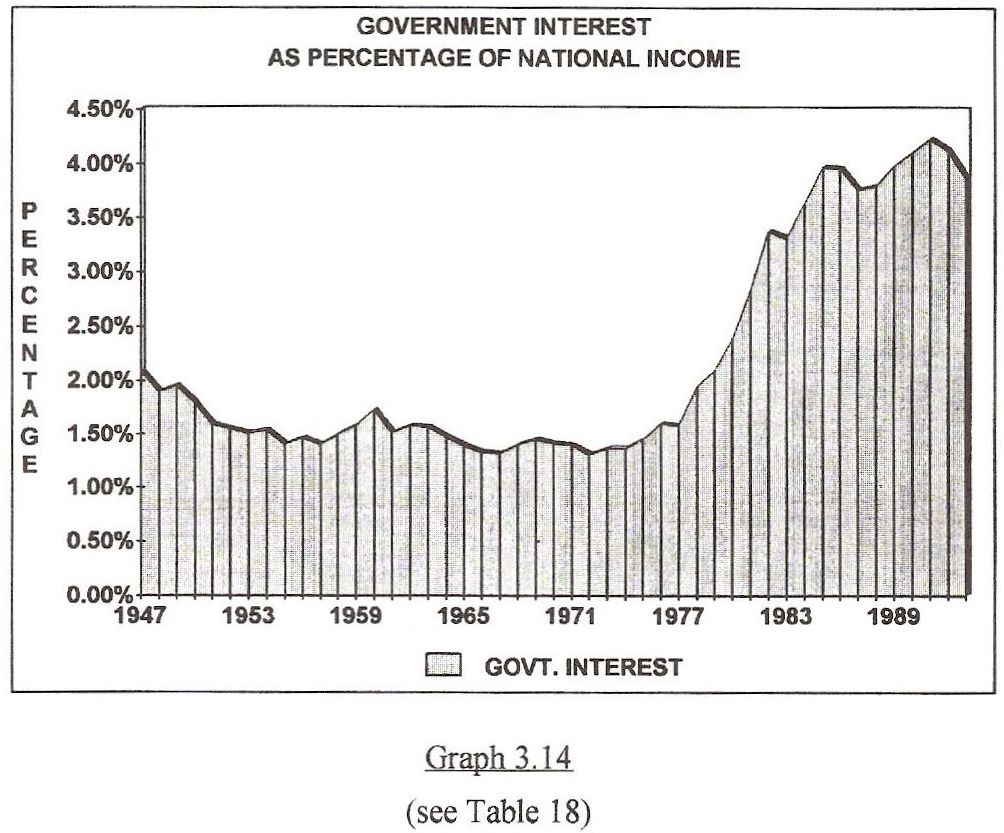

Graph 3.14

GOVERNMENT INTEREST AND DEFICIT SPENDING

Graph 3.14 displays the cost of government interest as a percentage of total National Income. The interest on the public debt as a percentage of National Income has almost doubled since 1980.

Graph 3.14 displays the cost of government interest as a percentage of total National Income. The interest on the public debt as a percentage of National Income has almost doubled since 1980.

Deficit spending plays a unique role in America because as government sells debt to the Federal Reserve System, the money supply is expanded. Thus, public debt serves an important function. Keynesian economic rules dictate deficit spending to stimulate economic growth, and thus, deficits are a fiscal and monetary tool. Also, increased government debt wallpapers over a troubled economy by financing entitlements and transfer payments to the disadvantaged.

Deficit spending plays a unique role in America because as government sells debt to the Federal Reserve System, the money supply is expanded. Thus, public debt serves an important function. Keynesian economic rules dictate deficit spending to stimulate economic growth, and thus, deficits are a fiscal and monetary tool. Also, increased government debt wallpapers over a troubled economy by financing entitlements and transfer payments to the disadvantaged.

Public debt is unnecessary regardless of economic conditions. United States Notes can deliver the same stimulus to the economy as deficit spending without adding interest to the economy.

Public debt is unnecessary regardless of economic conditions. United States Notes can deliver the same stimulus to the economy as deficit spending without adding interest to the economy.